RegTech companies have raised over $16bn since 2014, across almost 1,000 transactions, giving an average deal size in the sector of $16.4m and nearly 70% of this funding was raised in the past seven quarters.

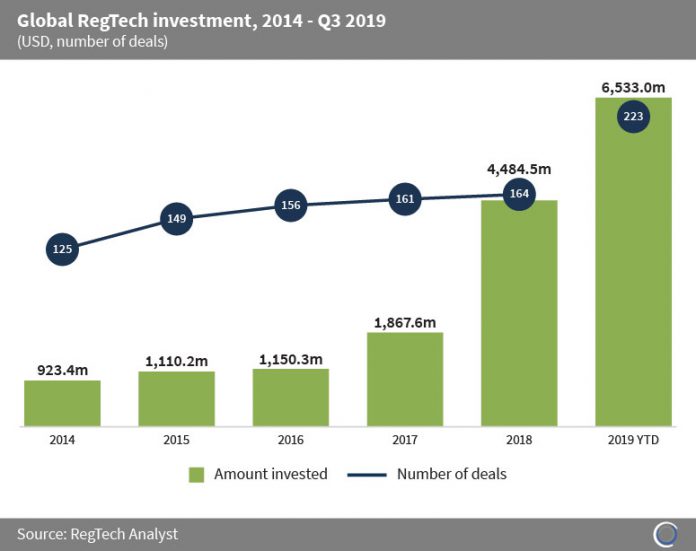

Investment has been in an uptrend over the past five years, growing almost five-fold between 2014 and 2018, as funding increased from $923.4m in 2014 to $4,484.5m last year.

More than $6.5bn has been invested in RegTech companies during the three quarters of 2019 across 223 deals, the strongest year for RegTech deal activity to date.

Of the more than $6.5bn that was invested in the first nine months 2019, almost $2.8bn was raised in Q3 2019, with 68 transactions completed during the quarter.

Verafin is a cloud-based cross-institutional software platform for fraud detection and management, serving more than 2,600 banks and credit unions. The Canadian RegTech company raised $387.8m in a private equity round led by Spectrum Equity and Information Venture Partners in September 2019, in order to aggressively pursue growth plans. This was the largest RegTech deal of Q3 2019.

Copyright © 2018 RegTech Analyst