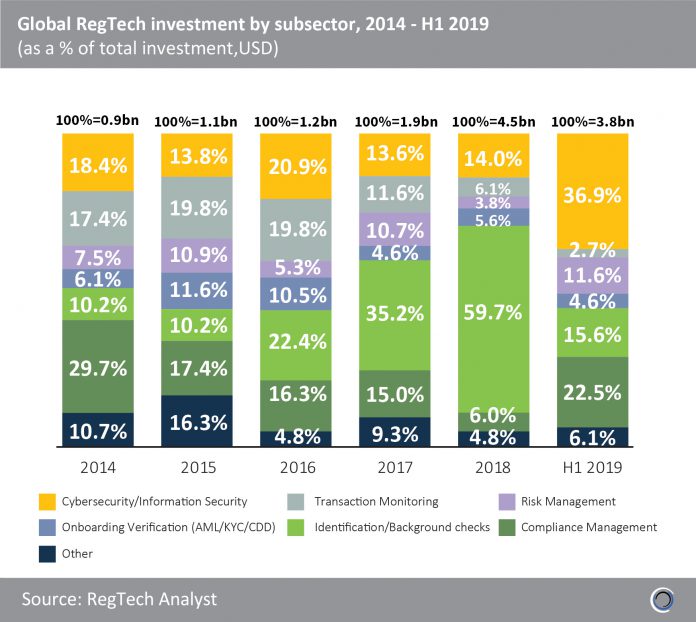

Investors have allocated capital right across the RegTech value chain over the past five years, with 21.3% ($2.8bn) of all RegTech investment during the period going to Cybersecurity companies. Cybersecurity companies within RegTech provide software and technology solutions that specifically addressing the challenges of financial regulations such as KYC and GDPR.

The share of investment going to Cybersecurity companies increased from 18.4% in 2014 to more than a third of RegTech funding in H1 2019, with investors pouring almost as much capital into the subsector in the first six months 2019 (nearly $1.4bn) as they did in the previous five years.

Despite capturing only 14% of the total capital invested in RegTech in 2018, cybersecurity companies raised $627.3m that year, up from $170.1m in 2014.

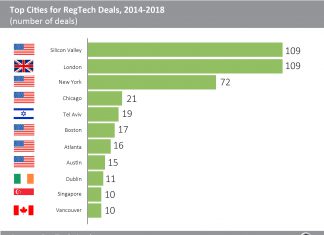

Geographically, there were 39 cybersecurity deals in North America in H1 2019, one in Asia, eight in Israel and six in Europe, with French companies capturing half of these deals. Vade Secure, an email security solution provider based in France, raised a $79.1m Series A round from General catalyst in June 2019. This was the largest RegTech deal in Europe last quarter and Vade plans to use the funds to build out its go-to-market strategy focused on servicing business customers through Managed Service Providers.

Copyright © 2018 RegTech Analyst