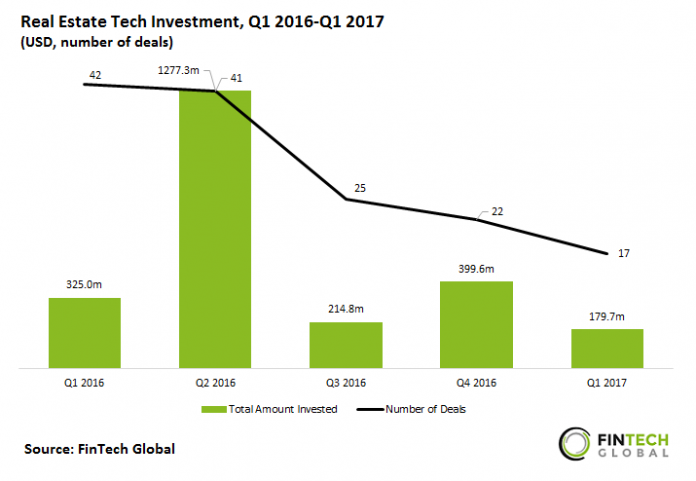

Q2 2016 saw record levels of investment in Real Estate Tech with over $1.25bn worth of funding

- Q2 2016 was the biggest quarter since the beginning of 2016 with $1,577.3m worth of funding. This investment total is over $150m more than the other four quarters in the Q1 2016-Q1 2017 period combined.

- Since Q1 2016, the amount of deals QoQ has decreased. In Q1 2016 the Real Estate Tech sector saw 42 deals, while in Q1 2017 there were 17 deals – a 59% decrease over the period.

- A hefty amount of Q2 2016’s total funding is down to the top two deals in Real Estate for 2016 both happening in that quarter. Both were for China-based Home Link (Lianjia) were responsible for $1.08bn of the total.

- If the top two deals are excluded from Q2 2016’s total, the average deal size for that quarter is $4.8m, the lowest of each of the five quarters in the period.

Real Estate Tech investments increase consistently YoY for 2014-2016 with 2016 a record year

- Real Estate Tech investments YoY from 2014 to 2016 grew at a CAGR of 106%. In terms of activity, the number of deals went up by just 2.4%.

- 2015 was a record year for FinTech investments in Real Estate Tech with 154 deals. The average deal size for 2015 was $7.1m.

- 2017’s total investment and deals are at 8.1% and 13.1%’s worth of 2016’s yearly total as-of the end of Q1.

Real Estate Tech’s diverse investment sees Residential & Commercial Real Estate receive the largest number of deals since 2014

- Investments for Residential & Commercial Real Estate attracted more funding rounds than any other sub sector within Real Estate Tech during 2014-Q1 2017 with 31.3% of the deals.

- Property Investment platforms also raised a sizable amount of investment traction with 18.9% of the deals.

- 8% is collated in a category called ‘Other’, this includes property maintenance services, predictive and property valuation tools, Real Estate lending services, as well as services that facilitate the buying of industrial Real Estate.

2016 sees Asia lead the way for Real Estate Tech investments for the first time with over half of the sector’s funding

- Asia saw itself assert a larger market share of Real Estate Tech funding during 2014-2016. In the period, Asia saw its share of global Real Estate Tech funding rise 21.2%.

- Europe has seen the reverse to what Asia has. In 2014 Europe saw 24.9% of the funding. That figure has now fallen to just 7.1% with the close of 2016, less than a third of 2014’s share. This is because, while overall funding has risen over four-fold since 2014, funding in Europe has risen by just 21.5%.

- North America’s share of funding in 2016 was low, respective to 2015 and 2014. 2016’s 35.4% share was the first time North America fell below Asia in terms of proportion of Real Estate Tech funding. This was a fall of 22.3% compared 2015’s share.

Home Link (Lianjia) receives over a $1bn of investment during 2014-Q1 2017 as China-based firms see the largest funding rounds in Real Estate Tech

- The largest Real Estate Tech investment during 2014-Q1 2017 was received by brokerage firm Home Link (aka Lianjia), the Beijing-based company’s Series B round equated to just over $594m (¥3.9bn approx.). The round came in April 2016 and was led by Huasheng Capital, with contributions Hillhouse Capital Group, Matrix Partners China, Source Code Capital, Tencent Holdings, and Baidu.

- Half of the top 10 investments went to China-based firms. The remining deals went to companies based in North America and Europe. Three were US-based companies (two deals for San Francisco’s Opendoor and one for Ladera Ranch-based Money360), the remaining funding rounds went to UK-based Real Estate lending firm LendInvest, and Canada-based Real Matters.

US-based Khosla Ventures and Y Combinator were each the joint-most active investors in Real Estate Tech for 2014-Q1 2017

- All three of the most active VC investors in Real Estate were US-based, with Khosla Ventures topping the most active list with eight deals between 2014 and Q1 2017. It was closely followed by New Enterprise Associates and Thrive Capital, who amassed seven deals each over the same period.

- Accelerators were also predominantly US-based, with London-based Seedcamp the only exception with six deals. Cambridge-based Y Combinator and Mountain View-based 500 Startups completed the top three most active accelerators with eight and five deals each, respectively.

- New Enterprise Associates participated in the largest funding round of each of the three most active VCs. They were an investor in Opendoor’s late-2016 $210m Series D round.

Real Estate Tech sees more late stage investment as the sector matures with Series B investments nearly equal to Series A investments in 2016

- The proportion of later stage deals (Series B and above) more than trebled during 2014-2016, rising 18.9% from 8.5% to 26.4%.

- The market share of funding going toward seed deals fell to nearly half of the overall total in 2016, a decrease of 9.9% since 2014.

- Overall the earlier stage deals i.e., Seed and Series A investments, had a share of funding which was 91.6% in 2014 – this figure fell to 73.6% by the end of 2016, a 18% decrease.

The Real Estate Tech sector looks to be becoming more mature YoY, as later stage dealings Series B and beyond become more frequent. Asia leads the way at present in a sector that has plenty of keen investors.

Copyright © 2018 RegTech Analyst