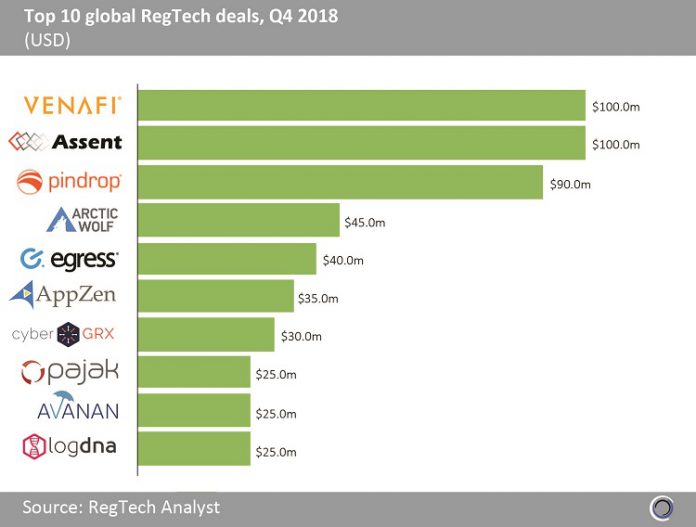

The top 10 global RegTech deals in Q4 2018 raised $515m, which is equal to 70.4% of the total capital raised in the quarter.

United States-based RegTech companies dominated with seven companies listed in the top 10, and the remaining three transactions involving companies based in the United Kingdom, Canada and Indonesia.

Venafi, a Salt Lake City-based cybersecurity company, raised a $100m Series E round from TCV, QuestMark Partners and NextEquity Partners in November 2018. Of this, $12.5m will be made available to third-party developers in the first tranche of Venafi’s new Machine Identity Protection Development Fund.

Ottawa-based Assent Compliance is a supply chain management software company that assesses third-party risks and educates stakeholders on regulatory and data program requirements. The company raised $100m of Series C funding from Warburg Pincus, which will enable Assent to continue the development of its product compliance and vendor management risk platform.

Egress, a London-based AI-powered cybersecurity company, raised a $40m Series C round led by FTV Capital. The company’s revenue has grown by 500% over the past four years, and Egress now has five million users across 2,000 enterprise and government clients.

Jakarta-based OnlinePajak, a tax compliance solution provider, raised $25m of Series B funding from investors including Warburg Pincus and Sequoia Capital India. This was the largest RegTech deal in Asia in Q4 2018 and In April 2018, OnlinePajak was recognized by the World Economic Forum as one of the world’s tech pioneers.

Copyright © 2018 RegTech Analyst