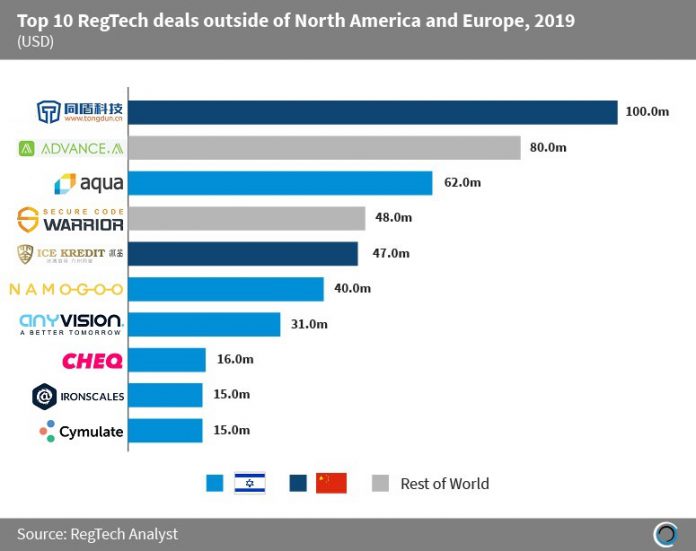

RegTech companies outside of North America and Europe raised $454m in the top 10 deals of 2019, which is equal to 73.7% of the total funding raised during the period. Six of the top 10 deals were completed by Israeli companies as the country becomes a key cybersecurity hub with an ecosystem of companies providing surveillance, detection and security solutions to the financial services sector.

The largest deal of the period was completed by Tongdun Technology which provides risk control and software solutions for fraud management applications in financial services, leveraging AI and big data analytics. The company, which is based in Hangzhou, raised $100m in Q2 2019 via a Series D round led by China Merchants Capital and used the investment to finance its exploration of artificial intelligence technology, R&D activity and talent recruitment.

Tel Aviv-based Aqua Security provides cybersecurity and compliance solutions to banks and insurance firms, giving full visibility and security automation across the application lifecycle, using zero-touch technology to identify threats and maintain compliance. The company raised $62m in a Series C led by Insight Partners in Q2 2019, the largest RegTech funding round completed by an Israeli company since 2015, bringing the total amount invested in the company to over $100m.

Copyright © 2018 RegTech Analyst