Contego, a UK-based RegTech and compliance specialist, has been picked by The Open Banking Implementation Entity to run ID checks and verify users.

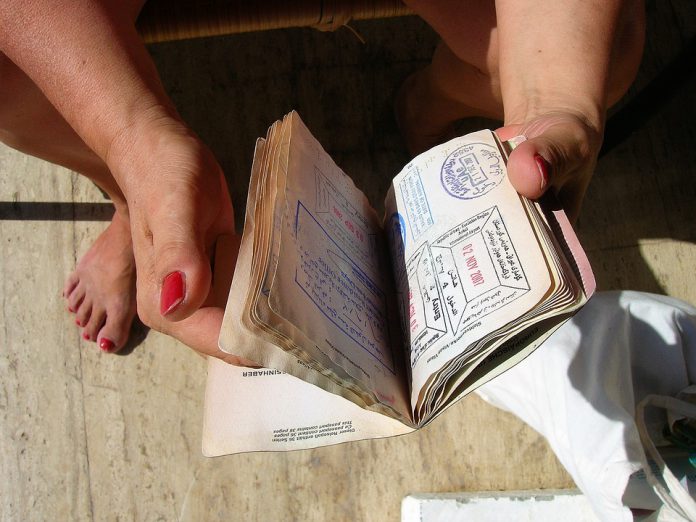

The company will support Open Banking’s identity-proofing and verification processes. Its platform provides a flexible, customised solution, with fully automated identity verification delivered in real-time, using a single API for high-speed onboarding. Contego’s streamlined process, in line with government standards, includes: online application, ID verification in real-time, and mobile ID document capture.

Open Banking is the retail banking industry’s response to the UK Government’s request for fairer, more transparent banking and financial services. In combining requirements under the UK’s Competition and Markets Authority and the European Union’s Payment Services Directive phase 2 (PSD2), the Open Banking standard was introduced across the country last week.

Nigel Spencer, head of support services at Open Banking said: “Contego has been very easy to work with; they have listened, and their approach is professional, transparent and consultative. Their ability to deliver a bespoke solution that combines automated identity checks with the added security of face-to-face verification made it the obvious choice. Contego’s technology innovations made them a clear front-runner when it came to deciding what firm to team up with to securely deliver Open Banking.”

Launched in 2011, Contego claims to be the only comprehensive risk scoring platform that can handle complex multi-source fraud detection and compliance checks on people, companies and ID documents. It combines data from a broad range sources with a proprietary risk scoring system to reduce the risk of fraud and make compliance checks and processes, such as AML (Anti Money Laundering) and KYC (Know Your Customer), as frictionless as possible.

The RegTech closed a £3.5m funding round, which was led by Maven Capital Partners, in July last year. The round featured NVM Private Equity and bought the company’s fundraising total to £4.7m.

Contego’s collaboration with Open Banking comes just months after it was hand-picked by a panel of industry experts for the RegTech 100, a list of companies that every financial institution should know about in 2018. The RegTech 100 is part of the Global RegTech review – an essential, in-depth analysis of the global RegTech market.

In the identification/background checks space, Yoti recently raised £8m in an equity funding round. The Digital identity platform raised the capital from existing angel investors and two of the company’s three founders, Robin Tombs and Noel Hayden.

KYC, which provides Know Your Customer and Anti-Money Laundering solutions for rapid ID verification, recently told RegTech analyst that it is looking to raise capital through a Series A funding in Q1 2018.

Copyright © 2018 RegTech Analyst

Copyright © 2018 RegTech Analyst