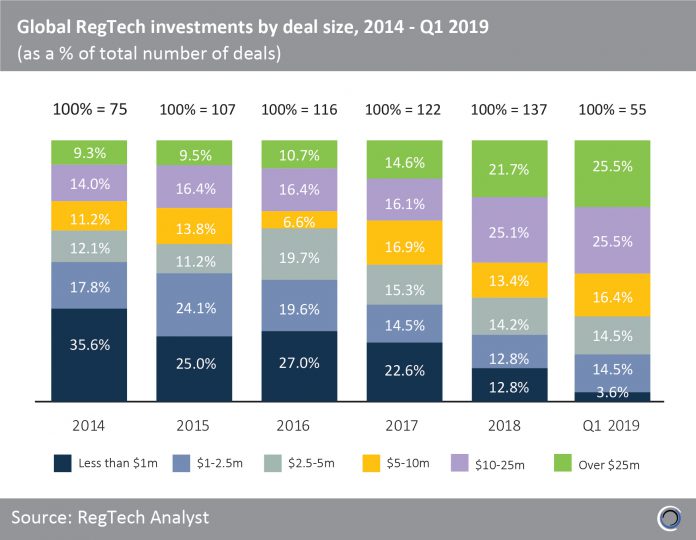

The proportion of RegTech deals valued below $2.5m fell from 53.4% of deals in 2014 to 37.1% in 2017 year as the industry shows signs of continued maturity. 2018 witnessed a continuation of this trend with just 25.6% of deals valued below $2.5m last year.

Concurrently the distribution of deals by size has shifted upwards with the proportion of transactions valued above $25m growing from 23.3% in 2014 to 46.8% last year.

The RegTech investment landscape has seen year on year growth of deals valued above $25m with more than a fifth of transactions in this deal size range closed in 2018, as investors engage in more later-stage deals. Anomali, a Silicon Valley-based threat detection solution provider, raised a $40m Series D round in Q1 2018 from investors such as Lumia Capital; an expansion-stage venture capital firm.

More than a half of the RegTech deals in Q1 2019 were valued at $10m and above, and more than a quarter of transactions were valued above $25m.

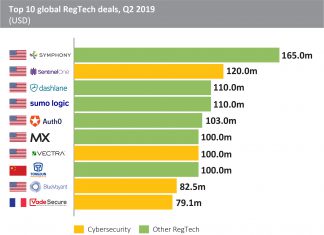

Kyriba Corporation, a San Diego-based treasury risk management solution provider, raised $160m of growth capital from Bridgepoint in March 2019, which was the largest deal in the risk management subsector last quarter.

Copyright © 2018 RegTech Analyst