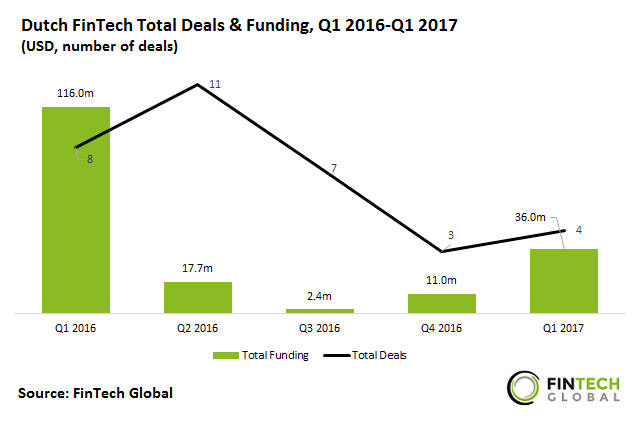

Dutch FinTech rallies in Q1 2017 after slump in Q3 2016, as the quarter receives the most funding since Q1 2016

FinTech in the Netherlands is maturing at a steady rate year-on-year, and is already well established in the country’s economic sector. It boasts a large amount of active companies, with Amsterdam being the hub of over 350 FinTech companies as of the end of the first quarter of 2017.

- Q1 2016 was a mega-quarter for Dutch FinTech, the second highest it’s ever had with $116m. This was largely down to a $100m debt financing round received by Amelo-based Qredits in January.

- Q3 2016 saw an average funding round size of approximately $0.35m, $14.15m below the $14.5m average deal size in Q1 of the same year.

- The one major debt financing deal for Q1 2016 aside, Q1 2017 has been a good quarter with positive signs. Q1 2017 saw the Dutch FinTech sector receive $36m, the sector’s best quarter since Q1 2016.

Dutch FinTech’s largest deals come from 2014 and 2016, while 2015 is Dutch FinTech’s most active year for deals

- 2014 has been the Netherlands’ most lucrative year to date in terms of FinTech investments, with nearly $260m in funding. This mammoth investment total was mostly contributed to by a $250m investment round for Amsterdam-based Adyen in that year.

- There was a decrease of 63.7% for the total funding in 2015 when compared with 2014, although 2015 did receive 10 more deals than 2014, a rise of 38.5%.

- Apart from the Adyen deal in 2014 and a $100m debt financing round Qredits in 2016, no other deals in the period received over $11m. Excluding those couple deals, the remaining 92 deals raised $189.7m combined, only 54.2% of the two largest deals’ total.

Dutch FinTech is seeing more later stage funding rounds year-on-year as the number of seed deals decreases each year since 2014

- The proportion of seed deals, typically funding for companies in the early stages of development, has decreased each year from 2014 to 2016. Its share of total deals decreased 27% in the period.

- Conversely, venture deals gained deal share each year consecutively in the period. Rising 16.4% to a point where deals of that type make up nearly a quarter of the total FinTech deals for the Netherlands in 2016.

- In 2016, the year with the largest proportion of venture investments to date, the largest venture investment was received by Utrecht-based software company Five Degrees, who raised $10.6m, the second largest deal for that year in the Netherlands.

Software for banks and financial institutions and accounting software dominate the Netherlands’ largest FinTech sector

- Banking Infrastructure and Accounting comprise over half to the sub sector’s total active companies.

- Security Technology and HR/Payroll software have an equal share of the sub sector’s space.

- The largest deal to come in the sub sector to-date was for Amsterdam-based Banking Infrastructure firm Frontclear, who pocketed $30m in February of 2017 in a round led by FMO.

The growth of Dutch FinTech is apparent as the total companies founded each year rises with moderate consistency between 2007 and 2015, with 2016 showing first genuine pullback in the period

- The total FinTech companies in the Netherlands surpassed the 350 total in 2016.

- 55 new companies were founded in FinTech’s most active year, 2014.

- FinTech total number of companies founded each year showed consistent growth over a 4-year period for 2011-2014, during which the total companies more than doubled when compared with the Pre-2010 number.

Interest in FinTech in the Netherlands is gaining pace with each passing year. With over 350 companies, of which of 150 are based in the country’s capital of Amsterdam, the country looks set to maintain a status of relative prominence in the global FinTech industry.

Copyright © 2018 RegTech Analyst