Financial services technology developer Even Financial has closed a $3m strategic investment.

Participation came from American Express Ventures, Plug & Play and Arab Angels.

Based in New York, Even Financial’s API provides analytics and insights to financial institutions and other partners, aiming to increase their customer applications and lower costs. Clients can use the API to offer personal loans, for home improvement, weddings, medical emergencies and debt finance, ranging from $1,000 to $100,000.

Even’s products for financial services providers include programmatic compliance, price optimization and risk mitigation, benchmark reporting and consumer marketplace.

For compliance, Even claims to ensure that a user’s products and services are displayed in full compliance with their regulatory and brand safety requirements. It monitors all touch points in real-time using advanced machine learning plus your rules, and manages communication and rectification.

The company’s offering also combines benchmark reporting and risk mitigation, meaning credit providers can leverage their insights to manage pricing at the channel level; driving down costs and improving vintage performance according to its website.

Even Financial hopes to use the new capital to expand its team and further the development of its technology.

American Express Ventures managing partner Harshul Sanghi said, “By providing the underlying technology for more efficient customer acquisition, Even’s platform is enabling financial institutions to broaden their reach while connecting fintech partners with a greater supply of financial institutions and their products.”

Last year, American Express Ventures contributed to the $16m Series B funding round of digital currency wallet Abra. The company offers a smartphone-based digital token wallet which can buy, sell, send and store both cryptocurrency and fiat money.

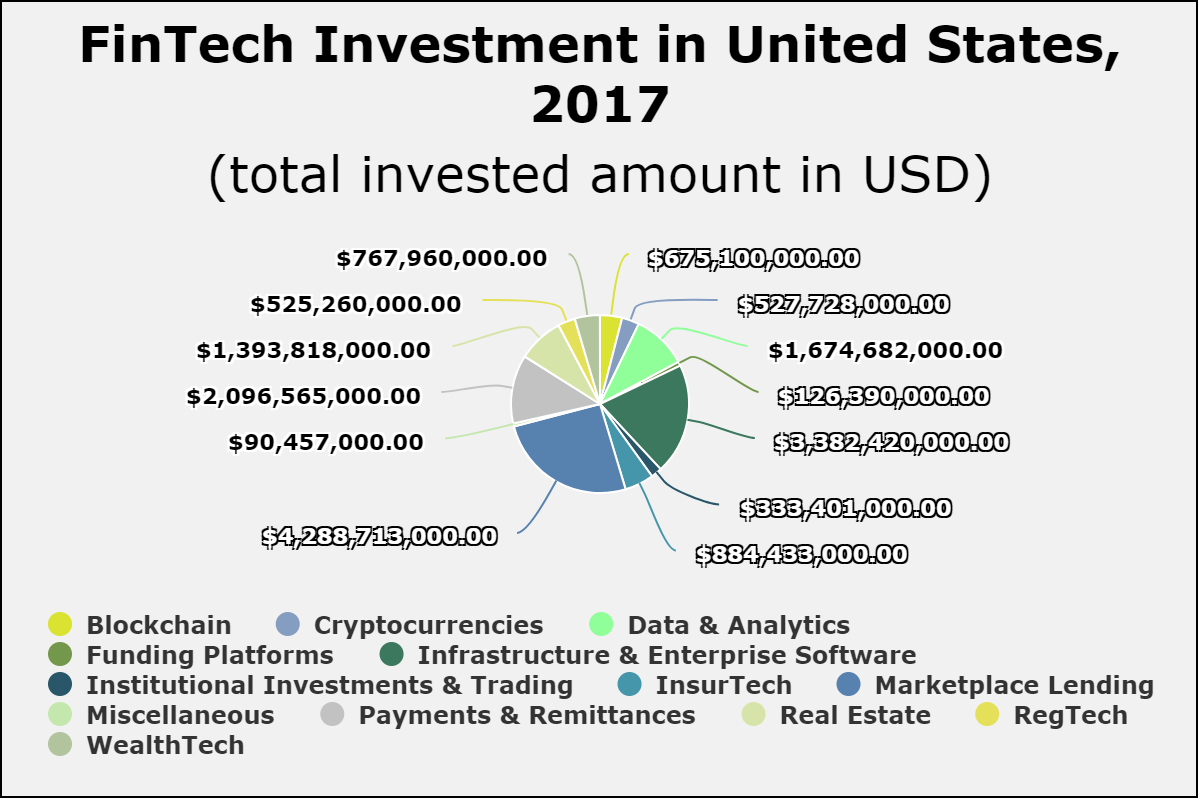

The United States’ FinTech sector is relatively diverse, but marketplace lending companies received the biggest proportion of capital according to data by FinTech Global. The sector received $4.2bn, which amounts to around 25 per cent of the capital invested in the country.

Copyright © 2018 RegTech Analyst

Copyright © 2018 RegTech Analyst