DPOrganizer, a Stockholm-based RegTech company, has closed is Series A funding round on €3m to help businesses comply with GDPR.

The company’s round was led by Nordic venture capital firm Industrifonden, with participation from Creades and existing investors. In august 2016, it received a €32,000 convertible note from Propel Capital.

It will use the new financing ramp up its global expansion, strengthen its product and keep growing the tech team at its headquarters in Stockholm.

With the increased complexity and risks deriving from the changing regulatory landscape, companies are required to improve their data protection practices.

DPOrganizer offers a Saas tool that helps businesses map, visualize, report on and manage their personal data processing. The software helps businesses comply with the General Data Protection Regulation (GDPR) which comes into effect on May 25, 2018, and affects any business handling personal data of European citizens.

Egil Bergenlind, CEO and founder of DPOganizer, said: “Hundreds of thousands of businesses will be affected by the GDPR, and we now stand better positioned to become an important player in the market. GDPR is not only about compliance, it’s about handling personal data in a way that your customers would expect you to. In short, it’s about trust.

With the deadline approaching, we find that more businesses are starting to do the work needed and understand the reasons behind having to do it.”

The company claims its offering enables business to take control and demonstrate accountability to minimise regulatory risk, business risk, operational risk and strategic risk.

It also claims to allow businesses to spend less time on administration, and more on dealing with issues that arise and making the right choices.

DPOrganizer was founded in Stockholm in 2015 by Egil Bergenlind, previously Chief Compliance Officer at iZettle.

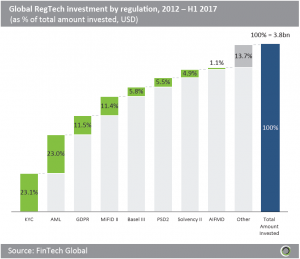

Earlier this year, research from FinTech Global found that GDPR was in the top three areas of legislation to receive the most investment. Since 2014, 23.1% of all RegTech investments, which amounts to nearly $878m, can be attributed to investments in KYC solutions.

The next two areas of legislation to receive the most capital are AML followed by GDPR, which received over $874m and $437m of investment, respectively.

Copyright © 2017 FinTech Global

Copyright © 2018 RegTech Analyst