Ireland-based Leveris, a core banking technology developer, has received a strategic investment from Link Asset Services.

Through the deal, Leveris will provide Link with a digital and adaptable solution to open up its banking and credit management offering. The new platform will support outsourcing opportunities within the banking sector and new technology.

Leveris is an end-to-end banking solution developer which facilitates lending, deposits, card issuance, and digital channel design. The company aims to support the online growth of traditional and challenger banks and lenders.

Its technology is build through APIs to help institutions to upgrade their existing solutions or make it easier to connect with other FinTechs and make full use of the open banking initiative. Alongside this, the platform is fully complaint with regulations such as PSD2 and GDPR.

The company uses real-time data to help a bank or lender build a better image of their customers, while AI and machine learning processes help to create predictive analytics.

Leveris founder and CEO Conor Fennelly said, “Link Group is the largest independent debt service in Europe and has a deep knowledge of the lending and loan administration industry, as well as being a global player in the financial services space.

“We both share a common vision to support financial institutions through the application of trusted and innovative technology and are deliberately ambitious in our quest to evolving banking into a simpler, more personal experience for everyone.”

Earlier in the month, digital banking and cryptocurrency trading API platform ORCA closed the initial round of its ICO on its $1.5m cap. Through the sale, the company distributed over 33 million of its tokens, which give holders to ability to add apps and services to their ORCA dashboard.

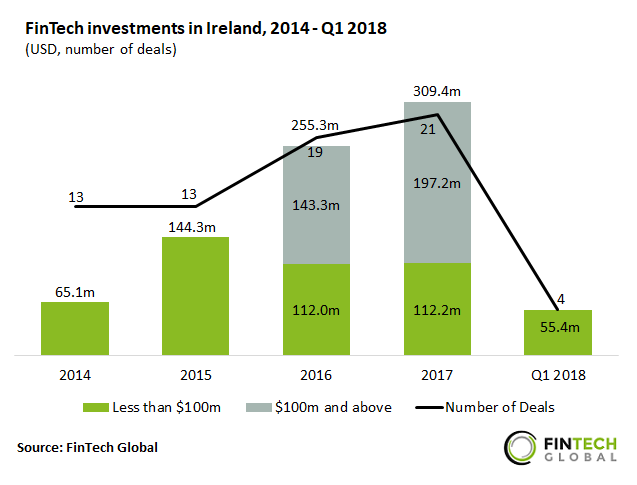

Ireland’s FinTech sector hit a record level for investment volume last year, according to data by FinTech Global. The country’s sector pulled in $309.4m in funding last year, making it just under five-times bigger than the amount raised in 2014.

Copyright © 2018 RegTech Analyst

Copyright © 2018 RegTech Analyst