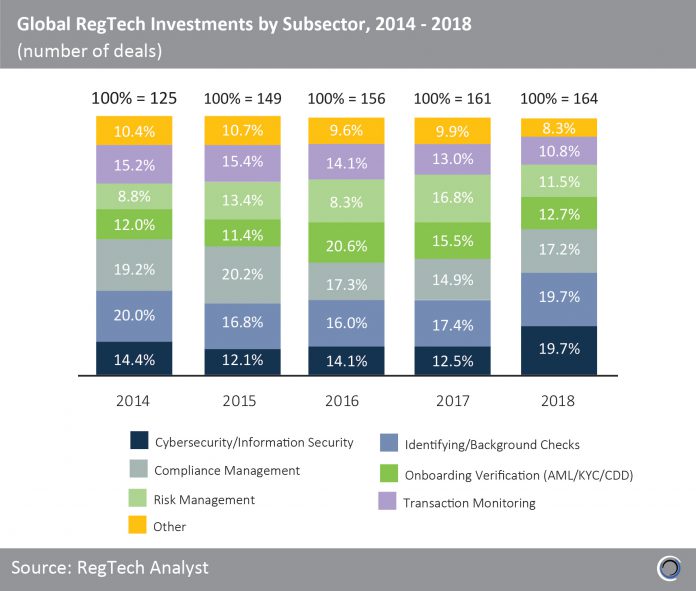

All RegTech subsectors have seen significant deal activity has over the past five years. The proportion of deals involving Compliance Management solution providers fell from 20.2% in 2015 to 14.9% in 2017 as the introduction of new regulations, such as MiFID II and GDPR, diverted investment activity to solution providers in other areas.

The share of deal activity involving Cybersecurity companies grew from 14.4% in 2014 to 19.7% of deals last year, as companies in Europe readied themselves for GDPR, implemented in May 2018. Venafi, a Salt Lake City-based cybersecurity company, raised a $100m Series E round from TCV, QuestMark Partners and NextEquity Partners which was the largest cyber deal in 2018. Of this, $12.5m will be made available to third-party developers in the first tranche of Venafi’s new Machine Identity Protection Development Fund.

The proportion of deals involving Onboarding Verification solutions providers peaked at 20.6% in 2016, indicative of the growing pressures that regulators around the world have placed on AML compliance. The Identification/Background checking subsector increased its share of deal activity from 16.8% in 2015 to almost a fifth of deals in 2018. LoginRadius, A Vancouver-based identity management platform, raised a $17m Series A round in Q3 2018 which was the largest deal in this RegTech subsector in Canada last year.

The share of deal activity involving companies in other RegTech subsectors, which includes Capital Planning/Stress Testing among others, has been stable, but dipped only slightly from 10.4% in 2014 to 8.3% in 2018.

Copyright © 2018 RegTech Analyst