From: FinTech Global

Money saving app Chip has been approved by the UK’s Financial Conduct Authority (FCA) as an authorised payment institution.

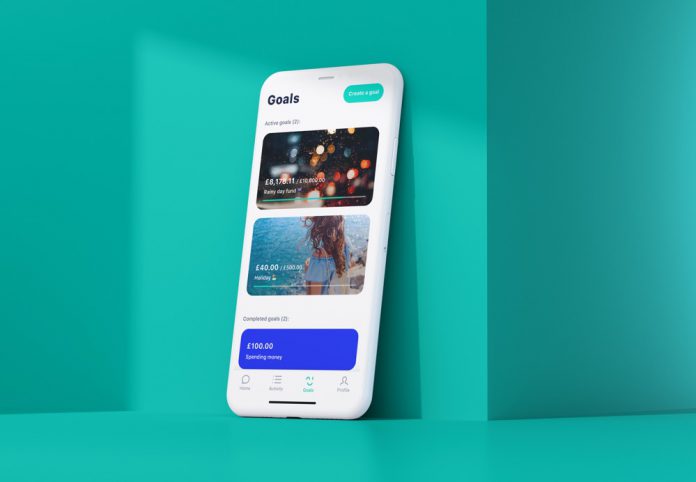

This means that Chip can now move on to the next step where it can introduce FSCS protected savings accounts through partner banks.

“The FCA authorisation unlocks a wealth of opportunities for Chip,” said Simon Rabin, CEO of Chip. “Over the last few days, we have had a spike in saver numbers as well as savers putting money aside for safety net funds. Now more than ever, we need to be agile and innovative in order to meet this demand – and this will enable us to do exactly that.”

“Millions of people in the UK have less than £100 saved up, which leaves them exposed to financial shocks. We’ve found that the average Chip saver can put aside around £1,800 a year, without noticing it, which can be a very useful amount of money if you find yourself in a pinch. Thanks to the new features as well as becoming an Authorised Payment Institution, Chip will become an even better and smarter tool for putting money aside – for the serious stuff in life as well as the fun.”

Gerard Hurley, chief compliance officer at Chip, added, “Becoming authorised by the FCA is a massive success for Chip. We had to go through a gruelling application process, but now this means that our customers and partners have even more trust in us. It also means that we can quickly release new products, which is incredibly beneficial as we have a very busy product pipeline ahead. Along with the introduction of new features, we’re entering a new era at Chip, and I’m very excited to see how we can help even more savers make it happen.”

Copyright © 2018 RegTech Analyst