China Merchants Group (CMG) has reportedly teamed up with an unnamed London-based firm to launch a $15bn technology-focused investment vehicle.

The China New Era Technology Fund will look to invest in China-based technology companies, as well as other global businesses, according to a report by the Financial Times. China Merchants Group and other unnamed Chinese groups will supply up to $5.9bn to the vehicle.

China Merchants Group is believed to be in talks with UK investment firm Centricus, which helped SoftBank raise its $93bn fund, and Chinese fund manager SPF Group, the article states. These two firms will be responsible for raising the remaining $9.1bn from governments, universities, and technology companies from around the world.

This vehicle will be run by China Merchants Group and a joint venture firm made by Centricus and SPF, it said.

Hong Kong-based CMG is a state-owned conglomerate which is based through three business platforms, non-financial industries, financial services and investment operation. The group operates across the finance, property and transportation sectors. Within the finance space, it has divisions in banking, securities, asset and fund management and insurance.

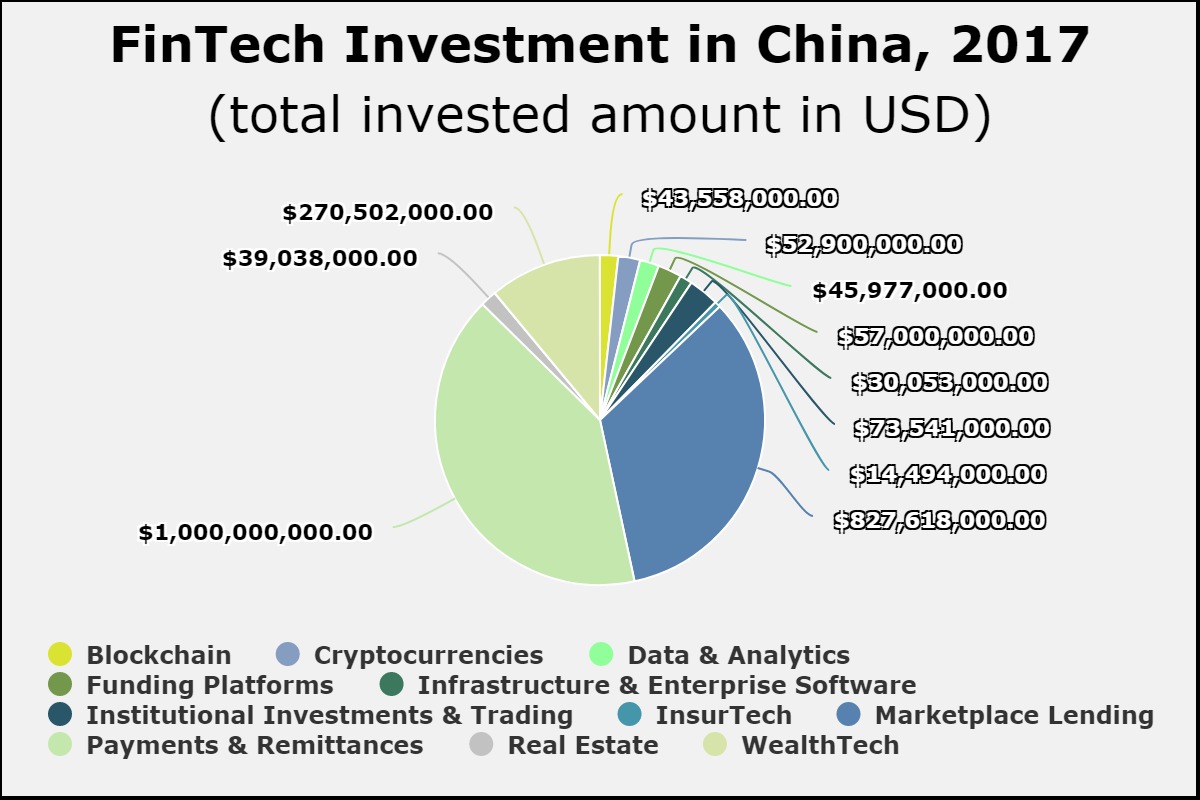

Last year, there was a total of $2.4bn deployed to China’s FinTech sector, according to data by FinTech Global. Around 75 per cent of this capital was invested into the payments and remittances, and marketplace lending sectors.

Copyright © 2018 RegTech Analyst