Are financial institutions struggling to keep up with modern sanction and PEPs lists? –...

FinTech Global recently spoke to multiple industry players to get their insights on whether financial institutions are keeping up with modern sanction/PEPs lists monitoring...

Are financial institutions struggling to keep up with modern sanction and PEPs lists? –...

The war in Ukraine has underscored how quickly sanction and PEPs lists can change. Since 2022, the US, UK, EU, Australia, Japan and Canada have imposed over 16,500 sanctions on Russia, according to the BBC. The current turbulent geopolitical scene means financial services firms need to be ready for regular, and often sudden, changes to PEPs and sanction lists. FinTech Global recently spoke to several industry players to ask whether financial institutions are keeping up with the modern sanction/PEPs landscape.

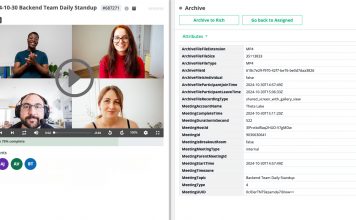

How Theta Lake empowers firms to maximise value from modern communication tools

A recent study from Theta Lake, a pioneer in digital communications governance, found that 69% of IT and compliance professionals expect the use of unified communication and collaboration (UCC) tools to increase in 2024. With firms using an average of 4.6 communication and collaboration tools, it is evident that UCC tools have become an embedded and essential part of modern business, but firms must ensure they are compliantly getting the full value of these tools.

Why communications monitoring is currently a ‘wild west’

The current communication monitoring landscape is a ‘wild west’, and firms need to ensure their processes are nimble so they can adapt to new and evolving communication channels.

Tackling money mule abuse of the financial sector – no place to hide

Money laundering is the lifeblood of organised criminals – put simply, without the ability to move and convert criminal proceeds into “clean” money to fund further crime and the lavish lifestyle criminals aspire to, organised crime gangs cease to function.

Why business email compromise should still be a top priority for a company’s cybersecurity...

Go back two decades and business email compromise (BEC) was a major threat to business security. Despite the advances of technology and cybersecurity, BEC is still as big of a threat as ever. However, it doesn’t need to be the case. There are solutions out there that can not only protect firms from malicious emails but prevent them ever getting into the inbox.

Asia-Pacific defies global FinTech funding decline: How it stands out in challenging times

There has been a global trend within FinTech over the past year – a drop in total funding volume. However, Asia seems to be defying this trend.

Will the Crypto Winter bring the death of cryptocurrency

Dubbed the Crypto Winter, the cryptocurrency market has gone through a tough period with companies collapsing, major fines and token prices dropping. However, players...

Regnology on ESG data and reporting: challenges, Europe, and the consequences of fragmentation

Regnology believes that ESG should be at the centre of a company’s activities, from finance to risk departments and credit ratings. A good ESG data strategy is key to this.

The Big Green Short – what is it and why should we care?

Globally, companies and assets are about to be revalued upwards or downwards according to their climate risk valuation. The stakes are high and the price of getting this valuation wrong could be disastrous, companies can no longer afford to kick climate risk down the road.