Top ten trends in wealth management in 2021 to look out for

As 2021 is kicking off, there are several trends in wealth management to look out for.

The 38 FinTech funding rounds raised last week highlight the success of payments companies...

From: FinTech Global

While the payments industry has reason to celebrate, last week also proved a boon for 38 FinTech companies closing investment rounds.

The FinTech...

Why the 25 FinTech rounds from last week mean huge things for buy now...

Buy now pay later companies continued their winning streak last week as 25 FinTechs raised big rounds.

How the fourth quarter saved the RegTech industry from suffering its first drop in...

RegTech companies set new records in both funding and the number of investment deals in 2020.

Revealing the ten biggest FinTech funding rounds in 2020

Massive amounts of capital have been injected into the FinTech industry in 2020, but ten companies raised bigger rounds than the rest.

Latin America and teen-focused FinTech services are coming of age as the industry closes...

Last week’s 32 FinTech rounds highlight how Latin America is exploding with new activity, how open banking has nudged closer to being fully adopted across Europe and the rising popularity of teen-focused ventures.

Revealing the top ten RegTech investors in 2020 so far

Venture capital firms continued to actively back RegTech companies in 2020 as financial institutions left the space.

What do these 28 FinTech rounds from last week reveal about the industry

Last week week saw 28 FinTechs close investment deals. Three sectors in particular proved especially successful.

Breaking: London is the hottest place in the world for RegTech investment right now

London wrestled the top spot for RegTech deal activity from San Francisco in the third quarter, now leading the 2020 investment league.

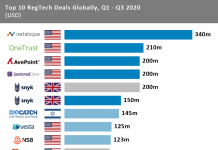

The first quarter of 2020 saw the highest number of large RegTech deals as...

The top ten RegTech deals in the first nine months of 2020 raised in aggregate $1.8bn, making up 38.2% of the total funding in the sector for the period.