Bandura Cyber, a threat intelligence gateway provider, has closed its Series A round on over $10m.

The exact amount raised for the series was not disclosed.

Tenfore Holdings served as the lead investor, with participation also coming from Grotech Ventures, Gula Tech Adventures, and Cultivation Capital.

As part of the investment, Tenfore Holdings investment director Joyce Shen will join the Bandura board of directors.

With the new funds, the RegTech is looking to accelerate its sales and marketing efforts to build upon current momentum with customers within financial services, healthcare, energy and the government. In addition to this, Bandura is looking to invest into product development.

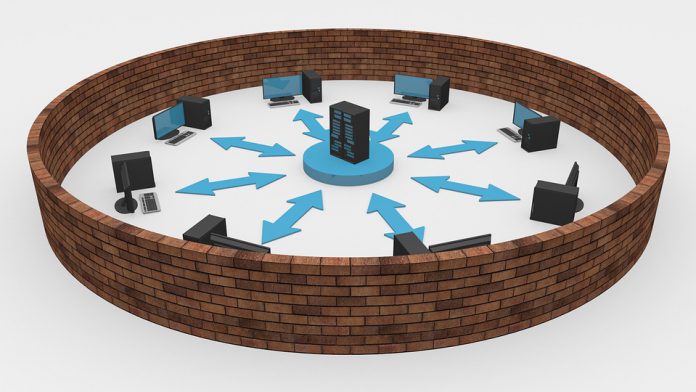

Missouri-based Bandura offers companies new ways to detect and block threats in an easy and automated manner. The Bandura TIG service can process more than 100 million unique threat intelligence indicators ahead of the firewall.

It is then capable of filtering both inbound and outbound traffic to shield the company from known threats and unwanted traffic, as well as lowering data exfiltration risk.

Tenfore Holdings investment director Joyce Shen said, “Bandura’s platform can give customers real ROI in investing in a first line of defense in cyber – helping customers to take action with threat intelligence in an automated and data-driven manner and at scale.

“The platform provides significant advancement in intelligent network defense that is ‘plug and defend,’ allowing existing CSOs and their teams to focus on value-added tasks. We are excited to be a part of Bandura’s growth.”

Last year, the company pulled in $4m in its initial batch of Series A funding. The capital was supplied by Grotech Ventures, Gula Tech Adventures, Maryland Venture Fund, and Cultivation Capital.

Copyright © 2018 RegTech Analyst