BABB (Bank Account Based Blockchain) has raised its $20m goal for its token sale, as it looks to receive a UK banking license.

London-headquartered BAAB is developing a decentralised banking platform which offers a bank account, payment card, and access to a P2P network. The mobile app will supply a bank account with face and voice recognition security, and tools for domestic and international transactions.

BABB hopes to connect banking to those that are underserved or excluded from traditional forms. The payments card, Black Card, connects directly with the mobile app through a QR code or NFC tag, and can be used at supported stores or online shopping.

The company hopes to launch its regulated blockchain-based bank accounts and mobile app by the end of the year. Capital from the round will accelerate the development of its platform, mobile app and payment card. BABB us hoping to get a UK banking license by the end of Q4.

BABB CIO Paul Johnson said, “We’ve got good feedback from the Bank of England and we’ve now got a second stage meeting with them to go through our business plan and explain how BABB is going to comply with regulations and meet our own objectives.”

Earlier in the week, UK-based challenger bank Atom closed a £149m funding round led by BBVA and Toscafund. The company raised the capital to support its growth as a lender, but to also fund development in its technology.

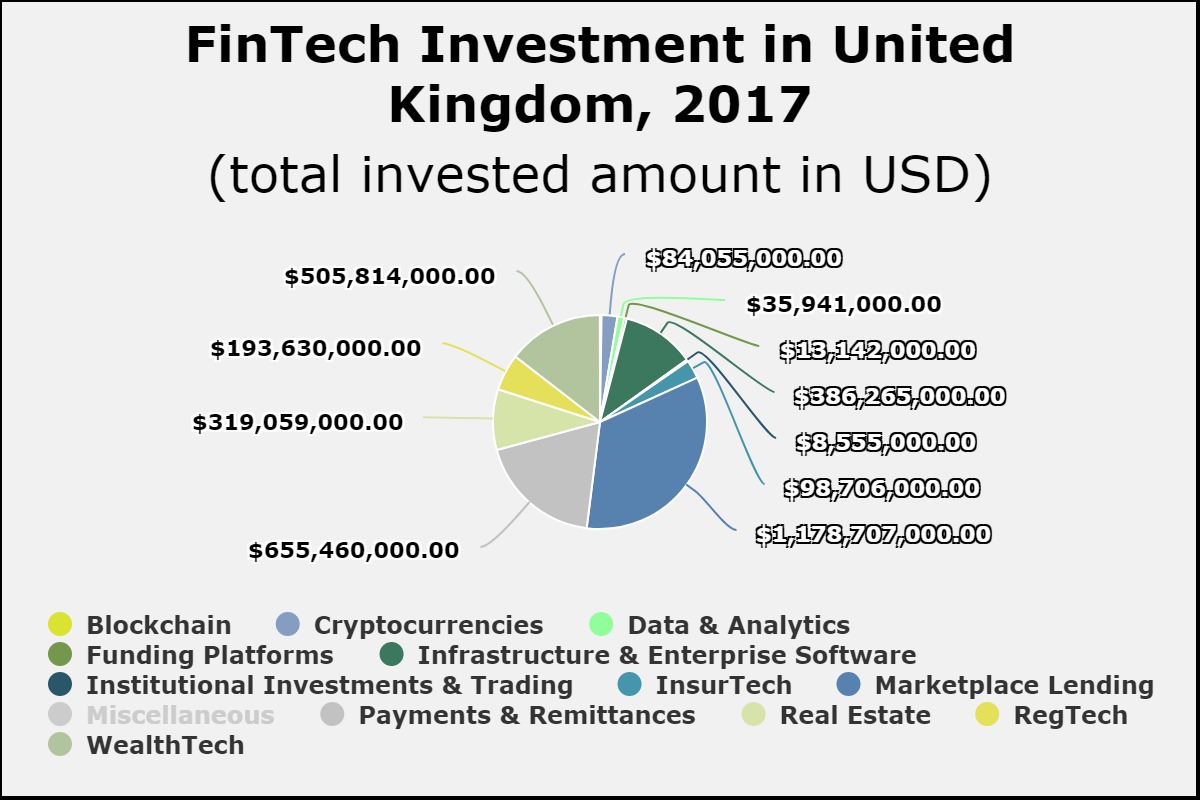

WealthTech was the UK’s biggest FinTech sector in terms of investment value, last year, according to data by FinTech Global. The sector raised $505m, and followed behind payments & remittances and marketplace lending.

Copyright © 2018 RegTech Analyst