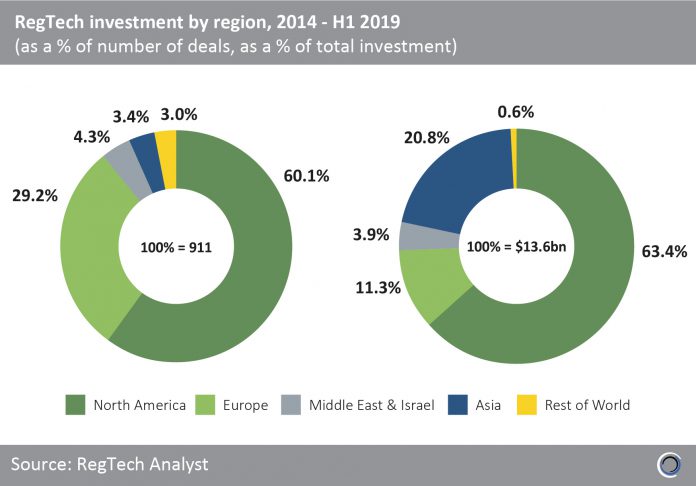

RegTech companies in North America have captured 63.4% of the $13.6bn that has been invested in the subsector since 2014, which is proportional to the region’s share of deal activity.

This regional dominance in terms of not only deal activity but capital is to be expected, given the depth of US capital markets and the consequent complexities associated with the regulatory landscape.

Europe is the second most active region for RegTech deals claiming 29.2% of deals globally since 2014, with more than $1.5bn raised across these transactions. Europe is home to key financial centres such as London, and to a lesser extent Frankfurt, which has led to a burgeoning ecosystem of RegTech solution providers.

Darktrace, an AI driven cybersecurity company based in Cambridge, raised a $75m Series D round in Q3 2017 which is the largest RegTech deal in Europe to date, and is now the most well-funded RegTech in the region having raised $230.5m.

Asian companies have been involved in 3.4% of deals since 2014 however, the share of capital invested at over 20% is skewed, due to the $2.6bn raised by Chinese facial recognition software developer SenseTime, across four rounds in 2017 and 2018.

Copyright © 2018 RegTech Analyst