RegTech companies have raised almost 2.5 times as much capital this year than they did in 2017

- More than $6.1bn has been raised by RegTech companies across 529 deals since 2014.

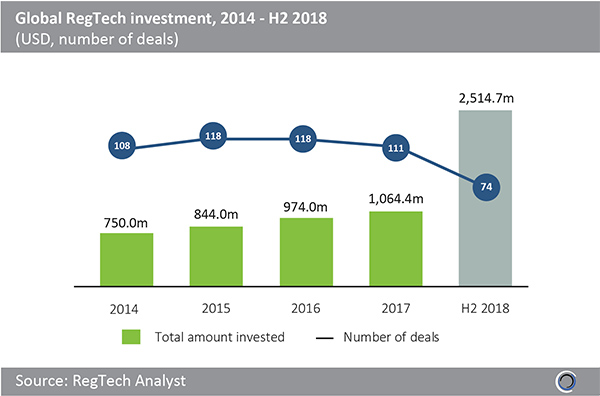

- The RegTech sector expanded steadily between 2014 and 2017, with funding increasing at a CAGR of 12.4% and annual deal activity staying above 100 transactions during the period.

- 2018 has been a standout year for RegTech investment, with funding reaching record levels. More than $2.5bn has been raised in the first six months of the year already, which is equal to 87.2% of the total capital raised by RegTech companies in 2015, 2016 and 2017 combined.

- The RegTech landscape is maturing as participants adjust to the implementation of new regulations, such as GDPR and MiFID II, and the spike in funding this year was driven by an increase in later-stage transactions. Sift Science, a San Francisco-based anti-fraud solution provider, raised a $53m Series D round in one of the largest RegTech deals of the year. This investment was led by Stripes Group and will be used to fund a global roll out of the company’s fraud prevention platform.

Q2 2018 sets a record for RegTech funding with nearly $2bn raised

- Investment in RegTech companies has grown consistently quarter on quarter, increasing 10x between Q2 2017 and Q2 2018.

- Q4 was the strongest quarter for RegTech funding in 2017, with 40% of the year’s $1.1bn total investment raised in that quarter. MetricStream, the market leader in governance, risk and compliance solutions raised $65m in venture funding. This funding led by Clearlake Capital Group, was the largest RegTech deal in Q4 last year.

- RegTech funding in Q2 2018 set a record, with $1.9bn raised across 36 deals, beating the previous high nearly 4x. Funding was dominated by two mega deals involving SenseTime, a Beijing-based facial recognition and identification solution provider, which raised $1.2bn in two separate transactions from investors including Alibaba and Tiger Global Management. SenseTime said that it has experienced 400% growth in each of the past three years as it encompassed more industries, with business contract revenue up more than 10-fold.

Almost $1.7bn was raised in the top 10 RegTech deals globally last quarter

- The top 10 RegTech deals in Q2 2018 raised $1.7bn, 88% of the total capital raised by RegTech companies last quarter.

- Previously mentioned SenseTime raised $1.2bn in two Series C rounds within months of each other, valuing the company at $4.5bn. A key focus for the company is to fund its internal talent development program, as it seeks to cut its reliance on externally-trained AI developers.

- Companies in North America were involved in eight of the top 10 RegTech deals last quarter, raising $473m. Checkr, a San Francisco-based background checking company founded in 2014, raised a $100m Series C round which was the joint largest RegTech deal in the region in Q2 2018. The funding was led by T. Rowe Price and the company has now scaled to running around one million background checks per month for more than 10,000 customers.

Investors are increasingly shifting their deal activity from companies based in the US and UK to other areas of the world

- US companies have claimed the lion share of global RegTech investment over the past five years, raising almost $3.9bn since 2014. However, US companies share of global deals declined from 64.8% of deals in 2014, to 55.9% last year, as investors look for opportunities in other parts of the world.

- The proportion of global RegTech deals involving UK-based RegTech companies has shown little variance, dipping from 14.8% in 2014 to 13.5% last year. Although UK RegTech companies share of deals fell between 2014 and 2017, investment more than doubled to $93.3m over the same period, as investors and solutions providers readied themselves for the implementation of new regulations such as MiFID II and GDPR.

- As the RegTech landscape matures, the proportion of deal activity has been growing in other parts of the world. There has been growth in RegTech deals in Asia with increased participation by Asian investors in this space, as the regulatory scrutiny of the region’s FinTech ecosystem intensifies.

- Singapore-based CashShield, a provider of fraudulent payments risk management solutions, raised a $20m Series B round in Q2 2018 in one of the largest Asian RegTech deals of the quarter. This funding was led by GGV Capital and Singapore-based Temasek Holdings, with plans to fund the company’s R&D programme.

The data for this research was taken from the RegTech Analyst database. More in-depth data and analytics on investments and companies across all RegTech subsectors and regions around the world are available to subscribers of RegTech Analyst. ©2018 RegTech Analyst

Copyright © 2018 RegTech Analyst

Copyright © 2018 RegTech Analyst