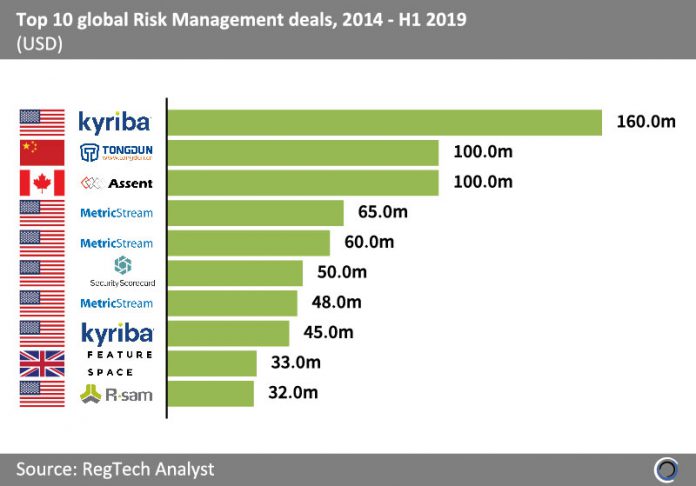

The top 10 deals between 2014 and H1 2019 involving risk management solution providers, operating within RegTech globally, raised $693m. The two largest deals occurred in Q1 and Q2 2019 respectively, with eight of the top 10 deals involving companies based in North America.

Kyriba is a cash and treasury risk management SaaS platform based in San Diego. Many of the world’s largest organisations rely on Kyriba to streamline key processes, protect against loss from fraud and financial risk. The company raised $160m from Bridgeport Capital in Q1 2019, which is the largest Risk Management deal globally to date. Kyriba also raised $45m in a Series E round in Q3 2017, led by Sumeru Equity Partners, with participation from existing investors Bpifrance, Iris Capital, Daher Capital and HSBC.

Tongdun Technology provides risk control and anti-fraud solutions for fraud management applications in financial services, leveraging AI and big data analytics. The Hangzhou-based risk management company raised a $100m Series D round in April 2019 from China Merchants Capital, China Everbright Limited, GGV Capital, Cinda Sinorock Capital and Guotai Asset Management in Q2 2019. This was the largest Risk Management deal outside of North America between 2014 and H1 2019.

Featurespace provides behavioural analytics technology for risk management and fraud detection in financial services. The Cambridge, United Kingdom-based solution provider raised $33m (£25m) led by MissionOG and Insight Venture Partners, which was the largest Risk Management deal in Europe between 2014 and the first half of the year. Featurespace will use the funding to support its international expansion and further develop its software capabilities.

Copyright © 2018 RegTech Analyst