Alior Bank has teamed with solarisBank, Raisin and Mastercard to launch a new pan-European digital bank.

Poland-based Alior made the announcement during the Impact 18 conference and is planning to launch the challenger bank in the fourth quarter of 2018. The digital bank will be built through a combination of services supplied by the various partners.

Alior will provide the multicurrency accounts with international transfers and deposits, while solarisBank will add the banking infrastructure through its technological, compliance and regulatory framework.

Raisin will use its network of partner banks to supply various savings and investment possibilities to the new company and MasterCard’s Benefit Optimization programme will support other ‘value-added’ services to customers.

The new product will be available to all EU residents, but will focus on Germany in its initial phase for the project.

Alior Bank head of FinTech Daniel Daszkiewicz said, “Thanks to this platform, customers will be able to access the best of each collaborator’s offer in a fast and efficient way. For example, a customer in Germany, while opening an account with solarisBank, will instantaneously gain access to a multicurrency account with Alior Bank and to Raisin’s savings products.

“Thanks to the cooperation with Mastercard on the other hand, customers will be able to buy additional value-added services that will facilitate clients global lifestyles. This is our first cross-border collaboration to this extent and it is a very challenging project at the same time, because it puts a bank in a totally new position.”

The open API platform will leverage opportunities created from PSD2 and open banking.

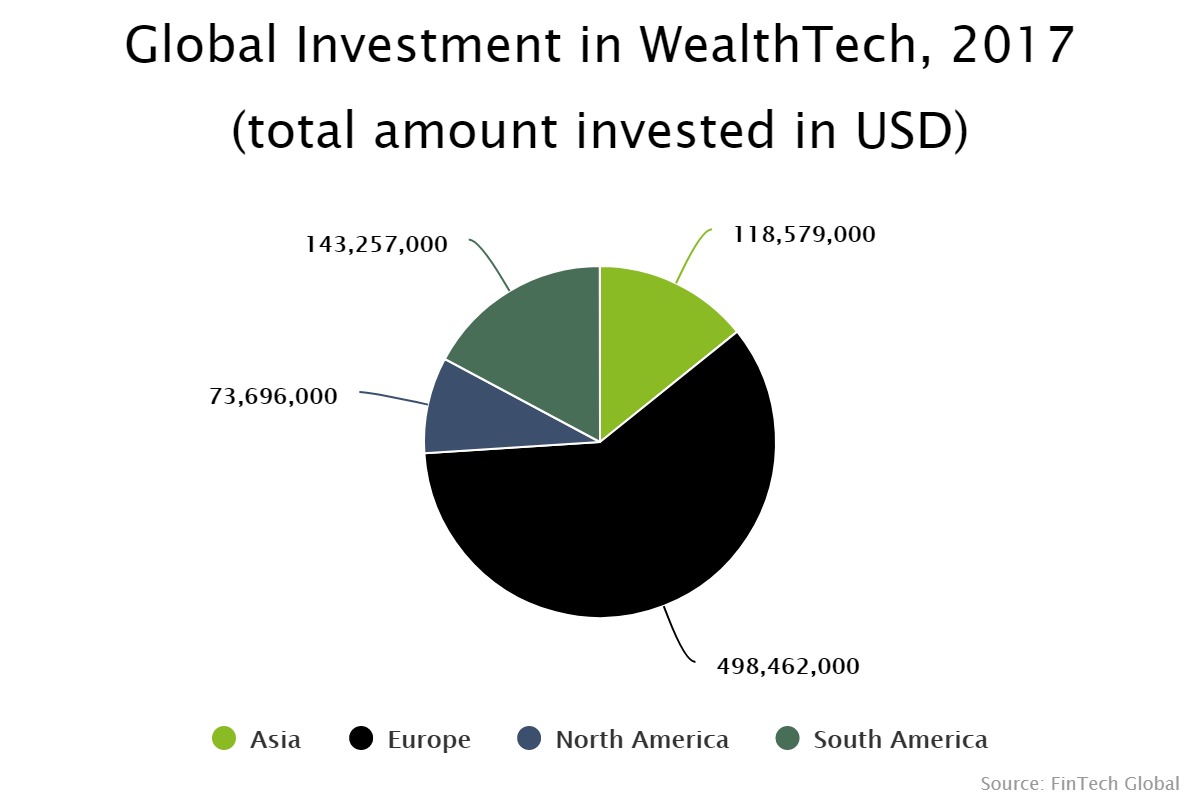

Last year, Europe dominated the online banking sector, in terms of funding, according to data by FinTech Global. Of the $834.1m deployed to the subsector, around 60 per cent of the capital was invested in Europe. The next biggest market was South America, which bagged 17 per cent.

Copyright © 2018 RegTech Analyst