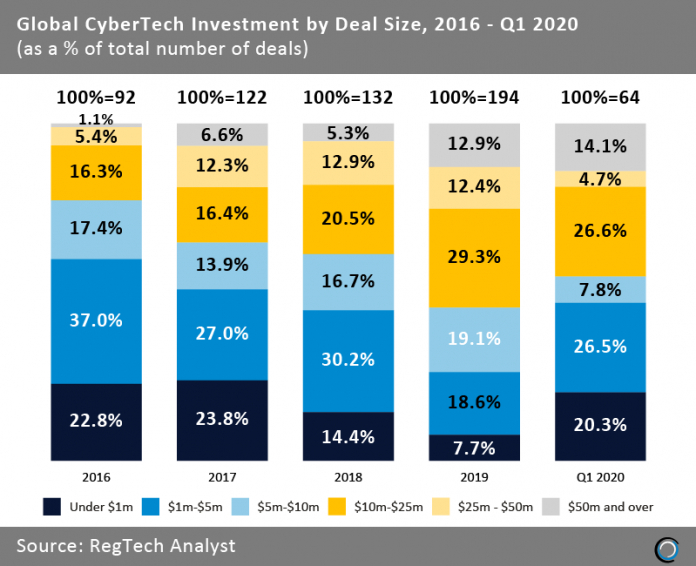

As the global CyberTech industry matured, the share for deals valued at $50m and over increased from 1.1% in 2016 to 12.9% in 2019.

That share increased even further in the opening quarter of this year to 14.1% with nine deals of this size being recorded.

On the flip side, the share of deals valued under $5m decreased by 33.5 percentage points (pp) between 2016 and 2019. However, that share rebounded to 46.9% at the start of 2020 suggesting that investors are showing renewed appetite for early stage deals and looking to back the next wave of disruptive innovation in the sector.

However, it is likely that we will see reversal of that trend in the second quarter based on observations of the investment landscape in countries hit earlier by the coronavirus pandemic, where investors stay away from riskier early stage deals due to the uncertainty caused by the virus and the expected economic downturn.

We recently announced the CyberTech100 list for 2020. If you want to learn more about the most innovative companies bolstering the defenses of financial institutions download our report at www.CyberTech100.com.

Copyright © 2018 RegTech Analyst