Canadian user authentication company Zighra has launched SensifyID, an AI-powered continuous authentication and threat detection platform.

The company’s flagship product, SensifyID, enables identity defense that safeguards against account takeover, remote malware, social engineering, and bot attacks. It runs machine learning and behavioural authentication algorithms to monitor user activity within an app, which is combined with data to offer continuous proof of the user’s identity according to the company. Zighra claims SensifyID delivers ‘rapid real-time behavioural intelligence’ and ‘powerful security controls’ to offer continuous proof of the user’s identity.

The Ottawa-based company built SensifyID based on its algorithms that learn user behaviour within 15 user interactions, compared to traditional AI algorithms, which take thousands of interactions to learn according to Zighra.

“The rise of mobile transactions and on-demand services have opened the door for well-organized, ill-intentioned actors to compromise accounts and commit fraudulent transactions across apps in banking, commerce and other industries,” says Deepak Dutt, CEO of Zighra.

“By adding SensifyID to our suite of AI-powered analytics, we are taking behavioral authentication to the next level by creating a unique, personalized cognitive profile that cannot be stolen or altered by humans or bots. Businesses that use Zighra’s SensifyID will know exactly when they are interacting with a human customer and when they are not, down to the very second.”

Last year, Zighra landed a $1m seed investment from MaRS Investment Accelerator Fund. The company also counts Chris Adelsbach, a Managing Director of Techstars fintech Accelerator in London, as an investor.

FinTech investment in Canada set to fall

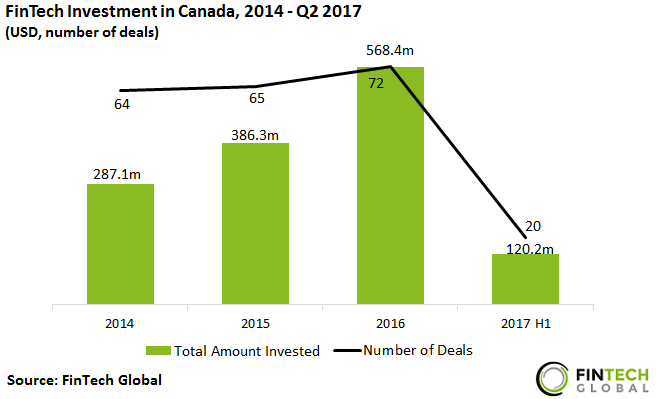

Despite FinTech investments in Canada progressively increasing between 2014 and 2016, the total investment for the sector look set to fall in 2017 according to data by FinTech Global.

The total amount invested in Canadian FinTech companies grew at a CAGR of 25.6% between 2014-2016. The total number of deals also progressively increased in the same period. The first half of this year has seen a slowdown in investments in Canadian FinTech Companies with only $120.2m invested across 20 deals. This amounts to only 21% of the total investments in 2016, suggesting that investments in 2017 will not reach levels set in 2016.

Copyright © 2017 FinTech Global

Copyright © 2018 RegTech Analyst