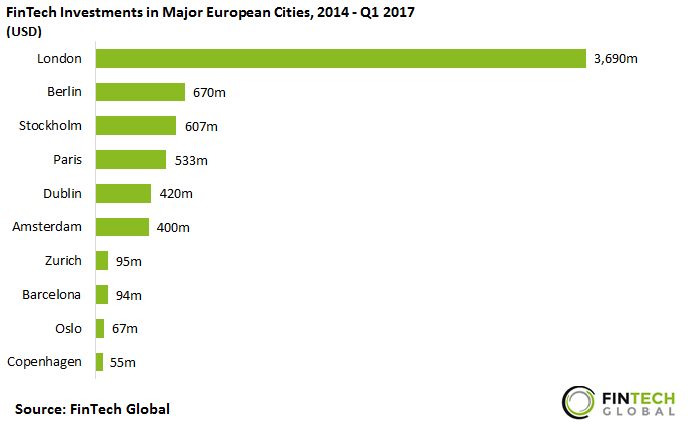

London leads the way along with Berlin and Stockholm in FinTech investments since 2014

- London received more investment in FinTech than the other major European cities combined.

- Following closely behind Berlin in third place is Stockholm, home to payments & Remittances giants iZettle and Klarna. The cities FinTech sector is dominated by WealthTech, Payments & Remittances and Infrastructure & Enterprise Software companies.

- Of the $533m invested in Paris over the last three years, $38.8m went lending company Microcred Group who specialise financial inclusion in Africa and China. Finalised in Q2 2016 this is the largest deal to Paris based FinTech companies since 2014. More recently mobile payments firm FAMOCO raised $11.7m in the largest deal in the city in Q1 2017.

London, Berlin, Stockholm and Paris receive the highest number of deals

- London retains its lead with just over 3.5 times the number of deals closed in Berlin between 2014 and Q1 2017.

- While Dublin was the fifth largest city for total investments it comes in at ninth place for its total deals. Over 60% of FinTech deals closed in Dublin are valued above $1m, with companies such as Future Finance raising $143.25m in debt financing in 2016.

- Unlike Dublin cities such as Amsterdam, Barcelona and Copenhagen see less than 30% of deals valued above $1m.

The top four cities; London, Berlin, Stockholm and Paris, have a strong start to the year.

- Berlin and Paris have both seen increases in their funding YoY since 2014.

- Stockholm saw a gradual fall in funding between 2014 and 2016. However, in Q1 2017 the city received 91.4% of the total funding in 2016. This is partly due to iZettle who raised a total of $63.4 in the quarter, via a debt financing round from Victory Park Capital and a $15m series D round from American Express, Creandum and others.

- The other three cities also had good first quarters. With London, Berlin and Paris raising 39.4%, 40.4% and 35.1% of their total investment in 2016, respectively.

Berlin is capturing increased share of FinTech investments in Europe

- Paris saw a 9% growth in their share of deals between 2014 and 2016, the largest growth of all four cities. This continued in Q1 2017 where the city received 19% of the deals closed across all four cities.

- Stockholm and Berlin have both seen gradual increases in their deal share between 2014 and 2016. However, in Q1 2017 Stockholm’s deals share fell to 12%.

- 2016 was the first year where Berlin, Stockholm and Paris received more than 50% of total deals for the top four cities. This trend has continued into Q1 2017.

Less than one third of the total amount invested in European FinTech goes to companies based outside of the 10 major cities considered above.

- $2.87bn was invested in European FinTech companies headquartered outside the top 10 cities by investment between 2014 and Q1 2017.

- In the period 2014 – Q1 2017 there were 740 deals closed to companies based outside the 10 largest cities by investment size. Compared to 1028 deals closed within those cities.

- Other locations that have raised large FinTech rounds in the past three years are Hamburg and Reading. Home to marketplace lending companies Kreditech Holding and FinanzCheck, Hamburg has received $501m of investment to 9 FinTech companies since 2014. Including a $200m debt financing round to Kreditech holding in 2015, the largest deal outside of the Major European cities considered above. Likewise Reading, which is home to HR platform Ceridian received an $150m deal in Q1 2016.

FinTech in Europe is thriving. While London continues to dominate the industry other cities such as Berlin, Stockholm and Paris are growing into successful FinTech Centres.

Copyright © 2018 RegTech Analyst