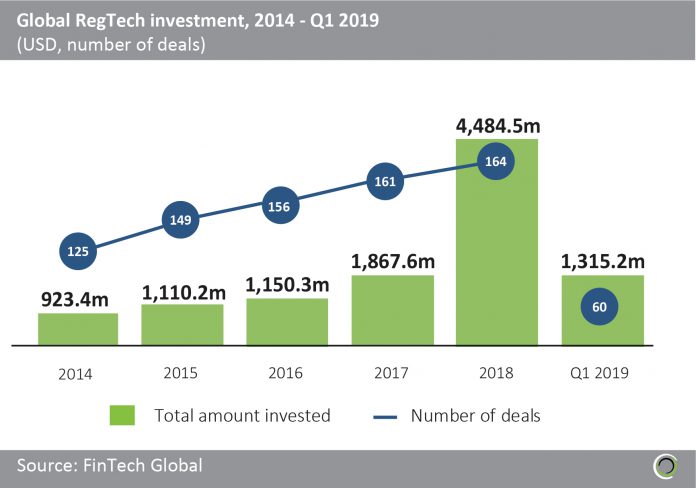

Global RegTech investment grew almost five-fold between 2014 and 2018. An increase of 48.5% CAGR, in terms of capital invested, saw funding grow from $923.4m in 2014 to $4,484.5m in 2018.

Funding doubled between 2014 and 2017, before jumping to just under $4.5bn in 2018. Deal activity has been in an upward trend between 2014 and 2018, with 815 deals completed during the period. Annual deal activity has remained above 120 since 2014, reaching 164 transactions in 2018.

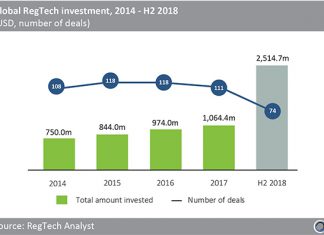

Funding in 2018 was bolstered by large transactions with SenseTime, a facial recognition solution provider, raising over $2.2bn across three deals. When we exclude the $2.6bn that SenseTime raised across 2017 and 2018, global RegTech funding still grew from $1,467.6m to $2,264.5m during the period. This increase was partly due to there being as many as 11 transactions valued above $50m in 2018.

Over $1.3bn was raised by RegTech companies globally in Q1 2019 across 60 transactions, which is greater than a third of the total capital raised last year and more than the annual investments in full year 2014, 2015 and 2016. London-based DueDil, which provides access to information on private companies, raised $4.6m (£3.5m) of debt from Shawbrook Bank, Oak Investment Partners, Notion and Augmentum Capital, which was the only debt funding deal in the subsector last quarter. DueDil will use these funds to scale-up, supporting brand growth, and product and infrastructure development. The company currently supports more than 400 clients across the financial services, FinTech and technology sectors and is also looking to continue partnering with companies in Europe.

Copyright © 2018 RegTech Analyst