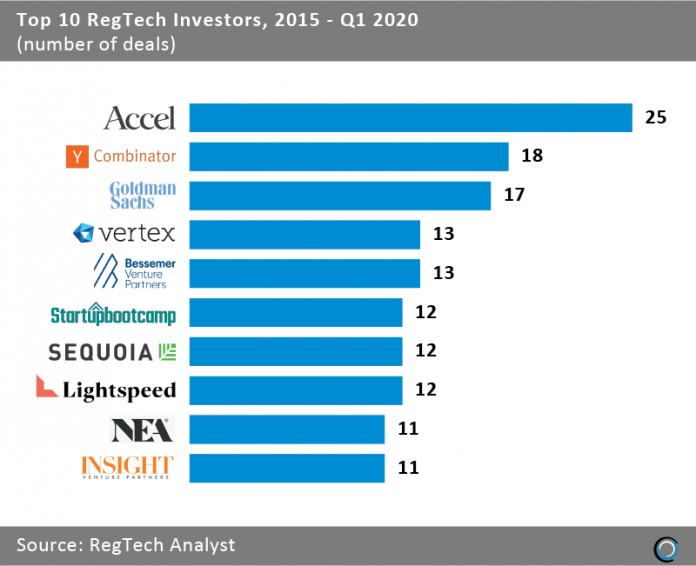

Who are the biggest RegTech backers and how many rounds have they each closed in the past five years?

The potential size of the global RegTech market is large enough that some of the major brand name venture firms have backed RegTech companies in the belief that they can grow into multi-million dollar companies. Indeed, VC firms take seven spots on the list of the top ten RegTech investors since 2015.

Accel has been the most active investor in the industry participating in 25 funding rounds. The firm’s founder Andrei Brasoveanu recognises the scope of the opportunity and implicitly added RegTech as one of the main investment areas of Accel’s last fund. The company most recently participated in the $80m Series C round raised by Privitar, a data privacy platform.

Surprisingly, there is lack of presence from financial institutions among the top investors in the market. Only Goldman Sachs takes a place on the list with 17 deals. The bank seems to realise that to hold its market leading position it needs to actively invest and be at the forefront of new digital innovation. Goldman most recently backed Very Good Security, a data security, compliance and privacy platform, in February. Goldman had previously participated in Very Good Security’s $35m Series B round in October 2019

Here are the top RegTech investors and how much they have closed. Accel has closed 25 deals, Y Combinator 18 and investment bank Goldman Sachs has completed 17 RegTech deals. Vertex and Bessemer Venture Partners have both closed 13 deals. Startupbootcamp, Sequoia and Lightspeed have each completed 12 RegTech funding rounds. NEA and Insight Venture Partners have also each closed 11 rounds.

Copyright © 2018 RegTech Analyst