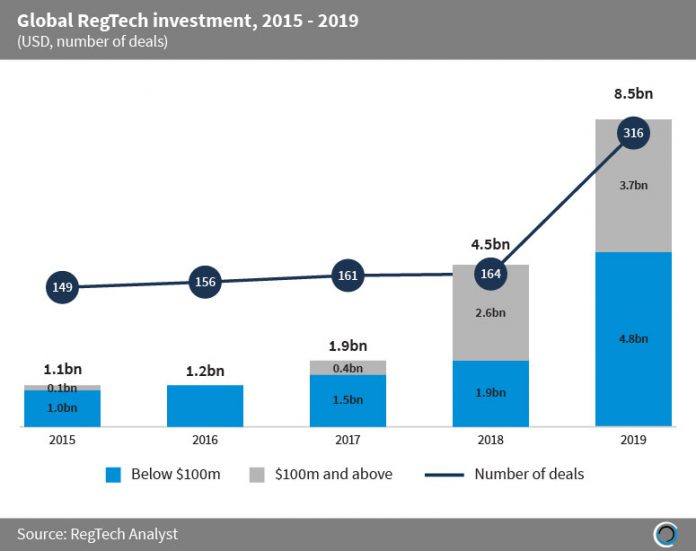

RegTech companies have raised over $17bn since 2015 across 946 transactions, with 39.7% of this capital being invested in transactions valued at $100m and above. Funding increased at a CAGR of 66.7% between 2015 and 2019, reaching a record of $8.5bn raised across 316 transactions in 2019.

Investment in global RegTech companies has been in an uptrend over the past five years, growing over seven-fold since 2015 to $8.5bn across 316 deals in 2019, the strongest year for RegTech activity to date.

Of the $8.5bn that was raised in 2019, 33.9% was raised in Q3 2019 alone, across 76 transactions, marking the strongest quarter for RegTech investment to date. However, the largest RegTech transaction of the period was raised in Q4 2019 by Databricks. The unified analytics solution collected $400m in a Series F round led by Andreessen Horowitz’s Late Stage Fund and pushed the company’s valuation to $6.2bn. The company will use the funding to fuel its global expansion and increase its research and development efforts.

Copyright © 2019 RegTech Analyst

Copyright © 2018 RegTech Analyst