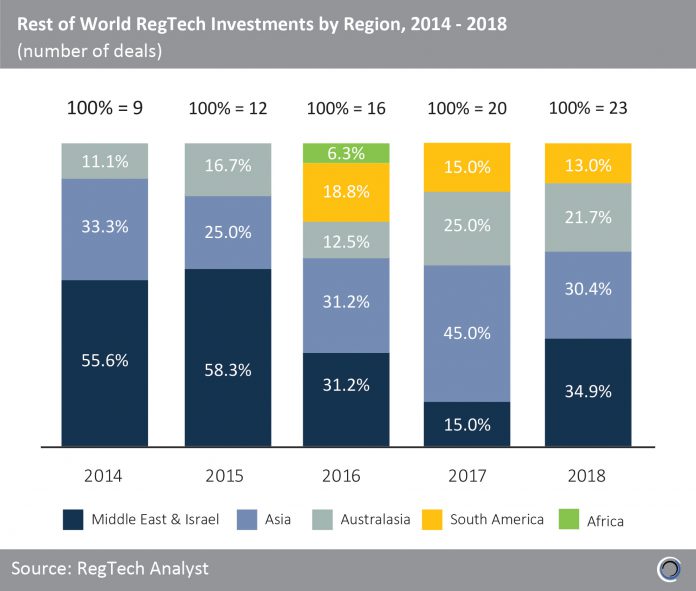

In 2014 and 2015, companies in the Middle East & Israel were involved in almost 60% of RegTech investments in the rest of the world. The sub-region’s control of the sector has shrunk dramatically over the years, as deals have been more evenly distributed among other regions since 2016.

Asia has become a dominant player, with the continent’s share of deal activity growing from 12.5% of transactions in 2013 to 45% in 2017. Companies contributing to Asia’s new surge in transactions in 2017 include Bangalore-based verification platform Perfios Software Solutions, which received $6.1m in a Series A round and Singapore-based blockchain technology company KYC-Chain, which participated in Supercharger FinTech Accelerator.

RegTech companies in South America have been raising capital since 2016, claiming 18.8% of deals that year, 15.0% in 2017 and 13.0% of transactions in 2018. Ceptinel, a Chilean risk management solution provider based in Santiago, raised $1m of venture funding from HCS Capital Partners in Q2 2018.

Africa is yet to establish itself in the RegTech sector, only completing one major investment so far, with Cape Town-based fraud prevention platform ThisIsMe, scoring a $2.5m funding round in 2016.

Copyright © 2018 RegTech Analyst