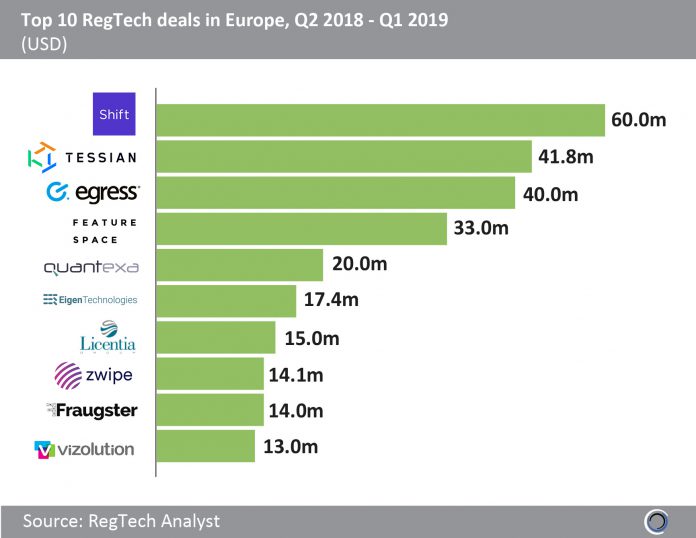

More than $268m was raised in the ten largest RegTech deals in Europe over the previous four quarters, with seven of these ten transactions involving RegTech companies based in the United Kingdom. The remaining three deals involved companies based in Germany, Norway and France.

Investors funded companies across the RegTech value chain, not limited to Cybersecurity, Risk Management, Identification/Background Checks, Reporting and Transaction Monitoring solutions providers.

Paris-based Shift Technology provides fraud detection solutions to the insurance industry. The French RegTech raised a $60m Series C investment in Q1 2019, led by Bessemer Venture Partners, with participation from Iris Capital, General Catalyst and Accel. The company has plans to bolster its global presence as well as increase its R&D spend for new product development.

Tessian, a London-based email security solution provider, raised a $41.8m Series B round also in Q1 2019 to accelerate its global expansion. This investment came from Sequoia Capital, LocalGlobe, Balderton Capital and Accel and was the largest UK RegTech deal last quarter.

Fraugster, a German anti-fraud solutions provider leveraging AI, raised a $14m Series B led by CommerzVentures in Q4 2018, and Oslo-based Zwipe, a Biometric Identification company, also raised a $14.1m Series B round in Q1 2019. Zwipe is working towards commercializing technology that embeds a fingerprint reader in payment cards to provide an added layer of security.

RegTech Analyst platform subscribers can check the full data behind investment activity in all RegTech subsectors.

Not a subscriber? Contact us today

Copyright © 2018 RegTech Analyst