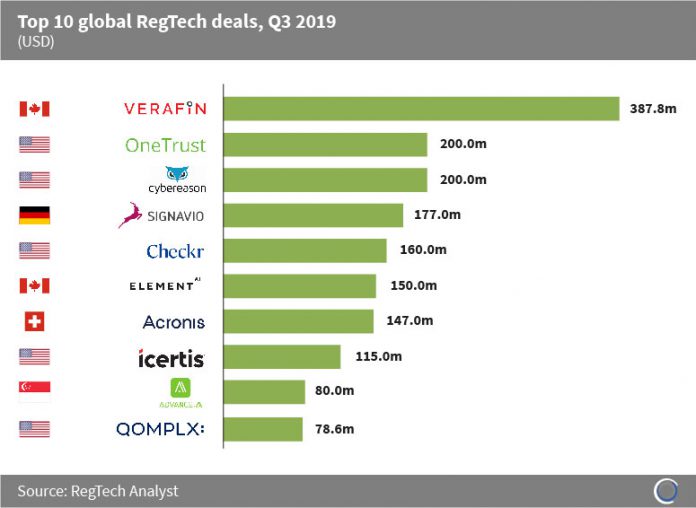

Almost $1.7bn was raised in the ten largest RegTech deals globally in Q3 2019, which is equal to 61% of the total capital raised in the sector last quarter.

North American companies dominated the list with two Canadian companies and five US companies represented.

Verafin is a Canadian cloud-based cross-institutional software platform for fraud detection and management, serving more than 2,600 banks and credit unions. The company raised $387.8m in a private equity round led by Spectrum Equity and Information Venture Partners in September 2019, in order to aggressively pursue growth plans. This was the largest RegTech deal of Q3 2019 and the largest RegTech deal in Canada to date.

Signavio is a business transformation suite offering solutions for compliance and risk management. The German RegTech company raised $177m in a Series C round, at a $400m valuation, led by Apax Digital in July, making it the largest RegTech deal in Europe in Q3 2019.

Advance.ai provides e-KYC and ID recognition solutions to financial institutions across the APAC region. Advance.ai, which is headquartered in Singapore, raised $80m in a Series C round led by Pavilion Capital and Gaorong Capital to spur growth in Asia. This investment which came from additional investors such as GSR Ventures and Unicorn Ventures was the largest RegTech deal in Asia last quarter.

Copyright © 2018 RegTech Analyst