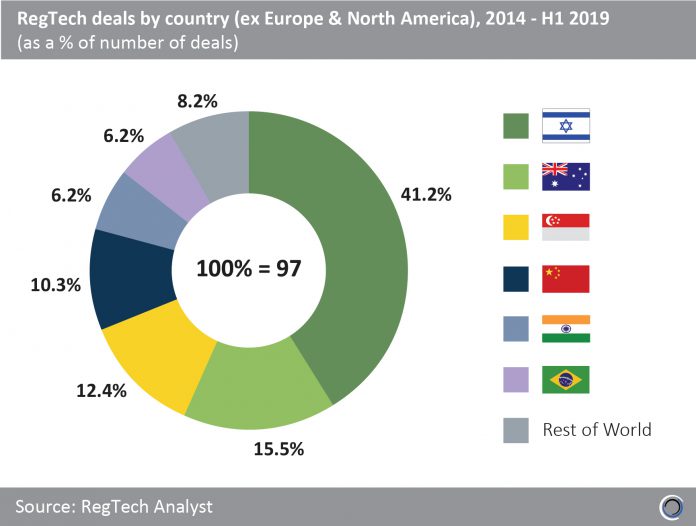

Companies in North America and Europe have dominated RegTech deal activity given the respective regions’ developed capital markets however, there were 97 RegTech deals completed in other parts of the world between 2014 and H1 2019, with over $3.4bn raised across these transactions. Israel, Australia, Singapore, China, India and Brazil have been the most active destinations for RegTech deals over the past five years, capturing over 90% of deals that have taken place outside of Europe and North America.

RegTech companies in Israel have captured more than two fifths of all RegTech deals outside of Europe and North America since 2014, with 35% of these deals involving Cybersecurity solution providers and 30% involving companies that offer solutions for Identification/Background checks.

Australia RegTech companies have been involved in almost one in six deals, with a third of these transactions occurring in the past 18 months. Data Republic, a Sydney-based privacy compliant data exchange platform, raised a $22m Series B round in Q4 2018. This funding, led by Singtel Innov8 with participation from Singapore Airlines, is the largest RegTech deal in Australia to date and Data Republic has used the money to expand into Singapore.

Other countries in the ‘rest of world’ outside of Europe and North America claimed 8.2% of deals between 2014 and H1 2019, with three deals involving South African RegTech companies. Gauteng-based DocFox enables financial institutions to carry out KYC procedures on any entity or natural person, from any country in the world. The company raised Money in May 2019, which was the first RegTech deal in Africa since the $2.5m that online verification company ThisIsMe collected in Q2 2016.

Copyright © 2018 RegTech Analyst