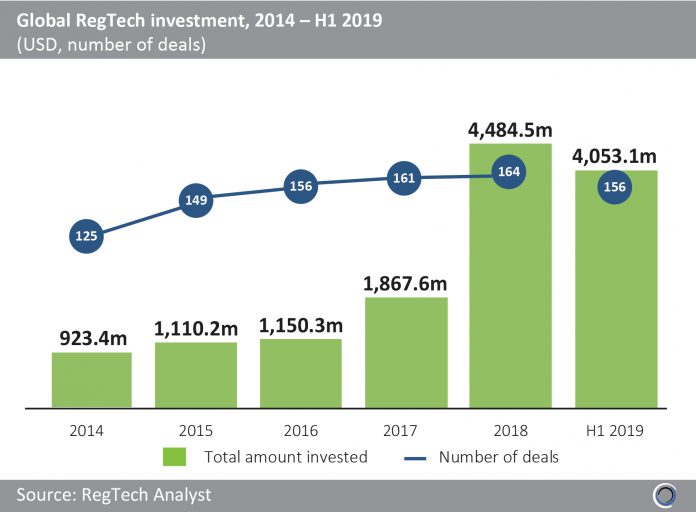

RegTech companies have raised almost $13.6bn since 2014, across more than 900 transactions. Nearly two thirds of this funding was raised in the past 18 months, which saw the introduction of two major pieces of regulation; MiFID II in January 2018 followed by GDPR in May 2018.

Investment has been in an uptrend over the past five years, growing almost five-fold between 2014 and 2018, as funding increased from $923.4m in 2014 to $4,484.5m last year.

More than $4bn has been invested in RegTech companies during the first half of 2019 across 156 deals, the strongest start to a year to date in terms of both deal activity and funding, setting strong expectations for the rest of 2019.

Of the more than $4bn that was invested in H1 2019, 67.5% ($2.7bn) was raised in Q2 2019, with 96 transactions completed during the quarter. Florida-based KnowBe4, a platform for security awareness training and simulated phishing attacks, raised $300m in a Series D round led by KKR in June 2019. This was the largest RegTech deal of Q2 2019, valuing the cybersecurity solution provider at $1bn.

Copyright © 2018 RegTech Analyst