Rocket Internet, a technology company investor and incubator, has €2.6bn gross cash available for investing.

The firm recorded a €10m consolidated revenue and a consolidated profit of €75m in Q1 2018. As of the end of May 15th, Rocket Internet has €2.6bn available and will use this to fund opportunities in the technology space.

Rocket Internet CEO Oliver Samwer said, “We have a great team looking for opportunities in FinTech and the AI-sector among others.”

The firm also repurchased 9.7 million of its own shares earlier in the month, and all 10.7 million treasury shares were redeemed. Following this, the share capital of the company was lowered to €154m.

Last year, Rocket Internet participated in the £1.2m funding round of London-based PropTech startup Nested. The company uses technology to value a property and provide the sellers with instant cash offer for it. A property will then be sold within 90 days, the owner gets to keep 80 per cent of the final deal.

Other FinTechs to receive an investment from Rocket Internet include property transaction platform Goodlord and P2P lending platform Funding Circle.

Rocket Internet CEO Oliver Samwer said, “In the first quarter of 2018, our selected companies continued to make progress on their path towards profitability, while demonstrating sustainable growth.”

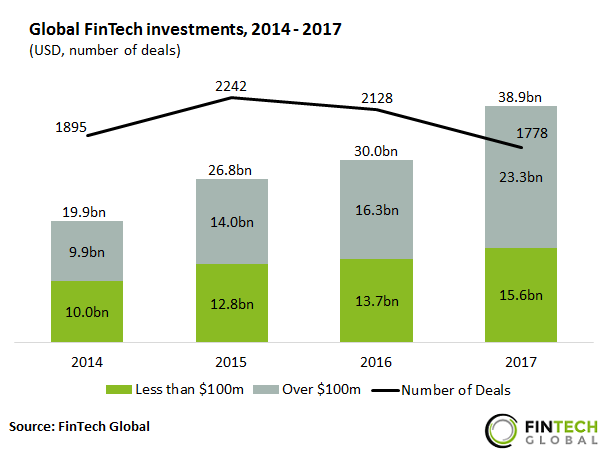

Global FinTech investments have nearly doubled since 2014, with last year seeing $38.9bn deployed globally, according to data by FinTech Global. Investments in 2017 increased by $8.9bn from the level reached in 2016 and was completed through 350 less transactions.

Copyright © 2018 RegTech Analyst