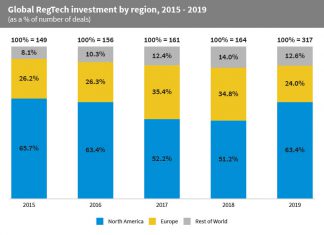

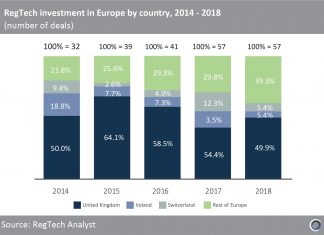

Europe has been the second most active region, after North America, for RegTech investment over the past five years, with financial and tech hubs such as London, Berlin and Tallinn spread across the continent.

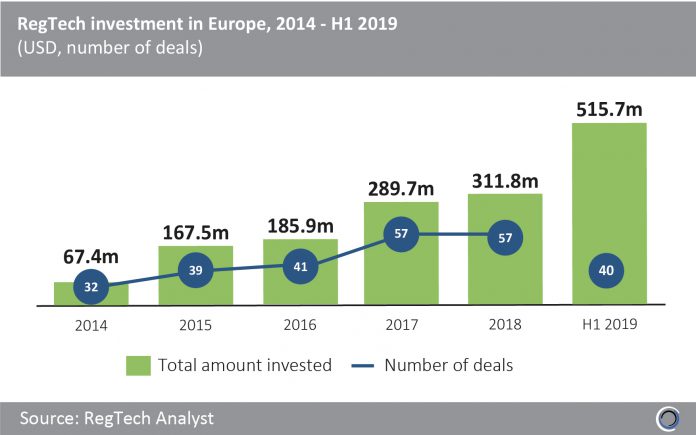

RegTech investors have poured over $1.5bn into companies based in Europe since 2014, across 266 transactions, with investment increasing in each of the last five years. The sector in Europe has continued to mature, evidence by the average deal size increasing from $2.1m in 2014 to $12.9m in the first six months of 2019.

Investment in Europe reached $515.7m in H1 2019, across 40 deals, setting a record for RegTech in Europe, with funding almost two thirds higher than the total investment in 2018.

London-based Kantox, a currency risk management platform, raised $5.6m from Silicon Valley Bank in April 2019. This was the largest RegTech debt deal in H1 2019 and Kantox plans to further develop Dynamic Hedging, which was recently named Best Risk Management Solution by Treasury Management International.

Copyright © 2018 RegTech Analyst