Linedata has partnered with London Stock Exchange Group’s UnaVista to effectively address MiFID II transaction reporting obligations.

Headquartered in Paris, Linedata provides solutions and outsourcing services to the investment management and credit finance industries. The partnership will see the firm’s mutual clients use UnaVista as an Approved Reporting Mechanism (ARM) to report transactions to National Competent Authorities (NCAs) for all required asset classes.

MiFID II comes into force today with the aim of bringing increased transparency and efficiency to financial markets and strengthening investor protection. The new regulation means that investment firms have to submit detailed transaction reports to their NCAs within one day of a transaction.

Using Linedata’s reporting interface, clients can send in data from multiple sources; UnaVista then determines which transactions are reportable and to which competent authorities it must be sent.

Arnaud Allmang, global co-head of asset management and servicing at Linedata, said: “Partnering with UnaVista is one of many ways that Linedata is supporting our clients to simplify and streamline their investment processes under MiFID II. We are delighted to partner with UnaVista to provide our clients with the best possible transaction reporting solution.”

UnaVista is London Stock Exchange Group’s global hosted platform for all matching, validation and reconciliation needs. It offers a range of business solutions through one interface designed to help firms become more efficient and reduce operational and regulatory risk across all asset classes.

The platform’s services include a G20 reporting solution, EMIR Trade Repository, Rules Engine, Swaps Portal, reconciliations, a regulatory reporting suite, data solutions, along with MiFID transaction reporting solutions.

“Our partnership with Linedata will enable mutual clients to utilize leading technologies from both organizations to fulfill regulatory reporting in a timely and efficient way,” said Wendy Collins, managing director, global strategic partnerships at UnaVista.

“UnaVista’s wealth of regulatory reporting experience will be key in helping Linedata’s clients automate workflows, and reduce regulatory and operational risk.”

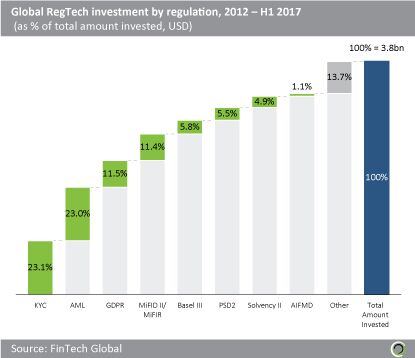

Last year, the Global RegTech Review revealed that the third most commonly addressed regulatory framework by RegTech companies is MiFID II/MiFIR, with 66 companies offering solutions to the regulation. The area of legislation to also received 11.4% of the total capital invested in the RegTech sector.

Copyright © 2018 RegTech Analyst

Copyright © 2018 RegTech Analyst