iSignthis, a company specialising in identity verification and payment authentication, has placed up to A$6.5m to investors.

The placement is a result of the successful Hong Kong, Sydney and Melbourne investor briefing, which led to both existing and new institutional investors indicating ‘a strong desire’ to participate in any future capital raisings the company planned according to a ASX release.

According to CEO John Karantzis, the funds came from some of Australia’s and Hong Kong’s top fund managers and institutions, each with multiple billion-dollar investment portfolios.

The capital raising, which is expected to provide the company with an additional $2.33m in working capital, will be applied to its own subsidiary iSignthis eMoney which trades as ISXPay. “The funds raised will be used to satisfy EU PSD2 ‘own funds’ Article 9 requirements to maximise ISXPay’s leverage and scale of merchants it can process and settle”, according to Karantzis.

“We intend to expand our sales and marketing activities to promote our ISXPay and Paydentity™ services, which are now operational in Australia, New Zealand and the EEA.”

Australian Securities and Frankfurt Stock Exchange listed iSignthis claims to be a global leader in remote identity verification, payment authentication and payment processing to meet AML/CFT requirements. It provides an end-to-end on-boarding service for merchants, with a payment and identity service via its Paydentity and ISXPay solutions.

The company delivers regulatory compliance to an enhanced customer due diligence standard, offering its global reach to any of the world’s 3.5Bn ‘bank verified’ card or account holders. iSignthis says its customers can be remotely on-boarded to regulated merchants in as little as 3 to 5 minutes.

iSignthis also announced that it has completed integration of its services to Australian Securities and Investment Commission (ASIC) regulated TraderQ. The agreement with the NAB allows ISXPay to offer full card acquiring payment facilitation services including processing, clearing and funds settlement to merchants, including TraderQ, of Visa and Mastercard transactions, in addition to BPAY payout facility to Australian cards.

RegTech

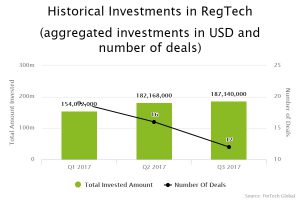

So far, more-than $523m has been invested in the global RegTech in the first three quarters of the year according to data by FinTech Global. Despite the amount of investment gradually increasing QoQ, rising to $187.34m in Q3 2017, the number of deals has decreased QoQ. In Q1 2017 the RegTech sector saw 19 deals, dropping down to 12 in Q3 2017. The data shows that the size of RegTech investments has increased over 2017.

iSignthis was recently hand-picked by industry experts for the RegTech 100, a list of companies that every financial institution should know about in 2018.

To find out which other companies make the list: www.RegTech100.com

Copyright © 2017 FinTech Global

Copyright © 2018 RegTech Analyst