Robo-advisory startup Fundvisory has raised €1.8m from Aviva France and Macif Group, to accelerate the development of digital savings in France.

Aviva supplied 60 per cent of the capital through its Innov ‘Now fund, while Macif supplied the remaining 40 per cent via its Macif Innovation Fund. Both organisations are already customers of Fundvisory and will now look to multiply the use cases.

France-based Fundvisory is a selection of automated applications to support savings for individuals and companies. Its solution offers CRM solutions and a robo-advisor to help its clients, which include Aviva, Generali, Natixi and ETFmatic.

Its services streamline and supervises collection and subscription of new products, informs users of and outstanding amounts which need to be collected. The company is the first automated B2B2C European financial consulting platform.

The company’s solutions are developed in compliance with DDA, MiFID 2 and PRIIPS. They meet the requirements of adequacy and traceability.

This equity line will help Fundvisory to continue development in France as well as preparing for launch into Europe. Areas of focus following this funding are increasing regulatory innovation, accelerating AI research and keeping up with demand growth.

Fundvisory is a laureate of the Public Investment Bank’s (BPI) Digital Innovation Competition in 2017. The company’s initial funding was a €300,000 capital injection from friends and family in 2016.

Macif Innovation director Stéphane Coste said, “This new investment is part of a long-term strategic partnership and is a step in the deployment of the Group’s innovation approach. It speeds up the provision, for employees, members and prospects, a digital innovation, in the field of finance, which facilitates their daily lives and complement the human relationship, the foundation of the service quality of the Macif Group.”

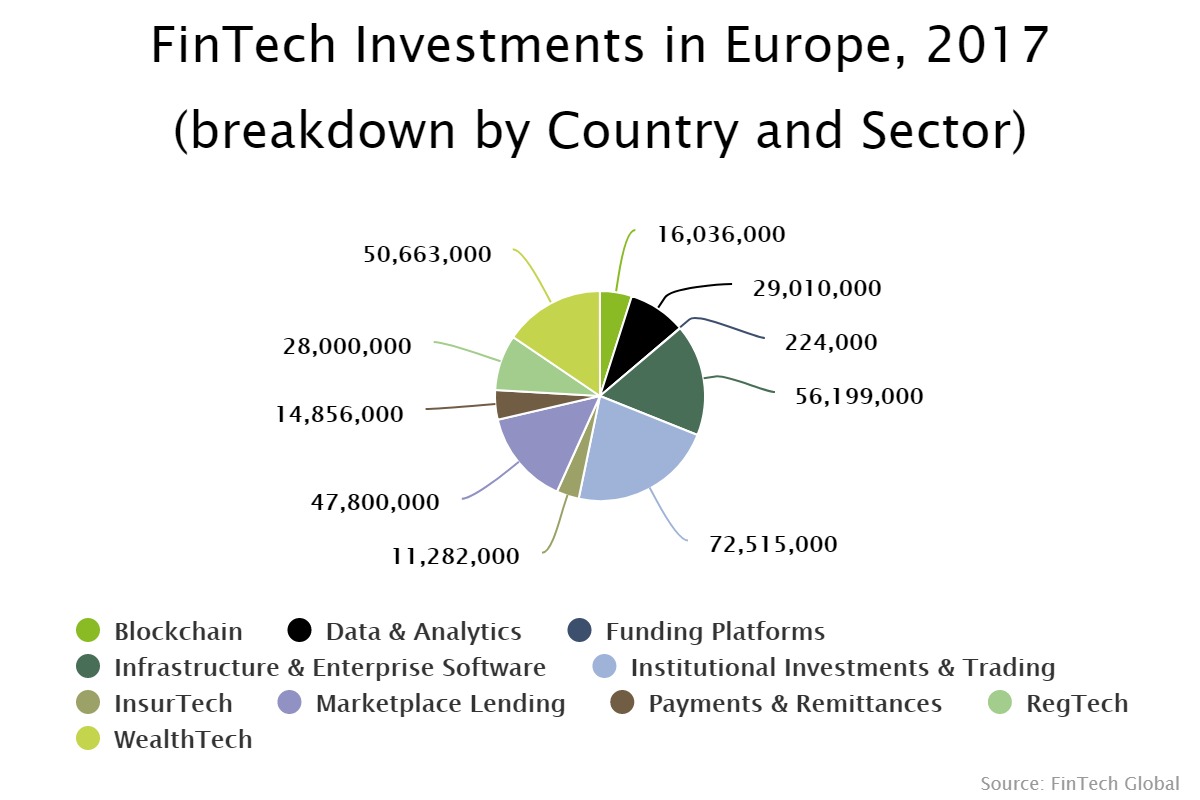

Last year, there was $323m invested into France’s FinTech space, of which the institutional investing and trading sector received the biggest share, according to data by FinTech Global.

Copyright © 2018 RegTech Analyst