FNA (Financial Network Analytics), which specialises in advanced network analytics and simulations, has received an investment from German cybersecurity firm Giesecke+Devrient (G+D).

This deal expands an existing partnership between the two companies for the development and distribution of a central bank digital currency (CBDC) simulation solution.

The extended collaboration will focus on creating enhanced software to enable central banks around the world to safely test and model the impact of CBDCs on the financial and economic system. With the fresh equity, it will empower FNA to accelerate innovation and build additional resources. It will also help the company make customer acquisitions when needed.

Existing FNA backers, IQ Capital and GettyLab, also joined the round. The size of the strategic investment was not disclosed.

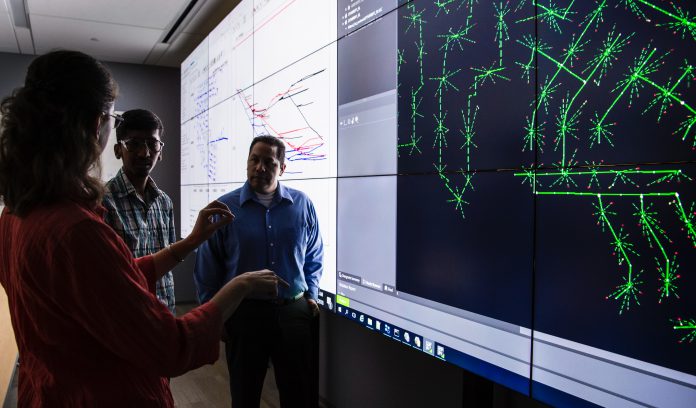

Founded in 2014, FNA has been building simulators for payment systems and networks. Its technology is designed to help financial institutions, central banks, national security organisations and financial market infrastructures to map and monitor complex financial networks. It also helps to optimise liquidity and simulate operational and financial risks.

CBDCs are becoming more popular, with around 67 believed to be under research, piloted or in development around the world. While the technology is being built, FNA claims many central banks do not realise the implications they could have on financial and economic systems. The platform being built by FNA and G+D will enable firms to run simulations to gauge impacts.

FNA founder and CEO Kimmo Soramäki said, “Our mission is to make the financial system safer and more efficient, and for more than a century, G+D has had the same objective, making them a perfect partner. As technology continues to change the world, how we interact with money is next in line for disruption.

“The unique combination and capabilities of FNA and G+D will allow us to provide the necessary software financial regulators and institutions need to prepare for the next evolution of the global financial system: the launch of the central bank digital currency.”

As part of the deal, G+D Ventures investment partner Assaf Shamia will join the FNA board of directors.

Copyright © 2021 FinTech Global

Copyright © 2018 RegTech Analyst