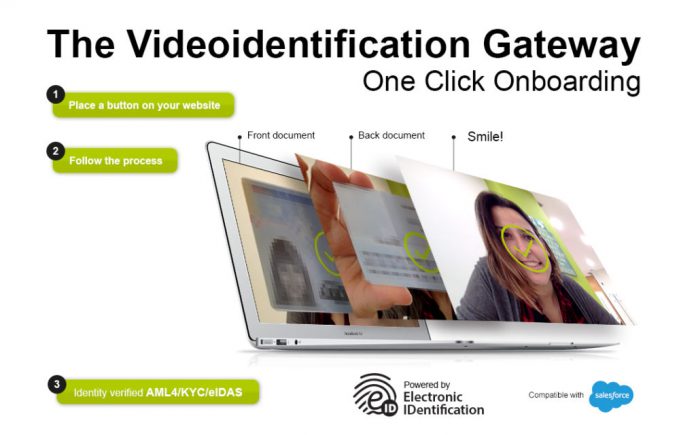

RegTech100 company Electronic Identification (eID) has launched One Click Onboarding (OCO), which provides video in just one click.

The RegTech claims that OCO enhances user experience, eliminating the need to integrate an API and enabling consumption in just a few minutes, giving users the front experience as a gateway. It works by capurting both sides of any official ID and the user’s face through a camera. By leveraging AI, the real time video will gather the information it needs to identify them just as if you were face-to-face.

OCO doesn’t require a long API integration process and in a matter of seconds it will be up and running, including a button on the website, launching identifications from the dashboard, through an email, or integrated into Sales Force.

The service provides the same validity as face-to-face and complies with the strictest regulations like eIDAS, AML4, and KYC.

In a blog post announcing the solution, eID said : “One Click Onboarding is ideal for FinTech companies, digital banks, or pilots in financial institutions who need to get on the market quickly to capture customers. They use our technology as an identification gateway instead of planning an API integration project which typically takes months to roll out.”

Founded in 2003, Electronic IDentification has created VideoID, which combines video streaming with machine learning and artificial intelligence algorithms to identify people in just seconds, from any device and through any channel.

The company claims that VideoID is creating a new services category in the Internet to identify customers remotely by providing the same technical security and legal compliance as face-to-face identification.

Self-Bank, the Spanish online banking subsidiary of French financial group Boursorama, is using a combination of video-conferencing, biometrics and electronic signatures from eID, to cut registration times for new customers onboarding.

On the other hand, Risk Management Solutions (RMS) uses the eID technology to offer a customer onboarding and KYC solutions that allows obligors an analysis in real time of clients and operations of financial institutions. This helps detect suspicious behaviour in the field of the prevention of money laundering and financing of terrorism.

Last year, Electronic Identification was hand-picked by a panel of industry experts for the RegTech 100, a list of companies that every financial institution should know about in 2018. Since Q4 2017, more than $3.2bn has been invested in the global RegTech sector. Out of that total, more than $234.6m went to RegTech100 companies, with 25 out of the 100 going onto to raise funds following the award.

More information – https://www.electronicid.eu/one-click-onboarding-oco-new-video-identification-just-one-click/

Copyright © 2018 RegTech Analyst