Private equity firm Clearlake Capital Group has purchased Perforce Software, a provider of enterprise scale software solutions, from Summit Partners.

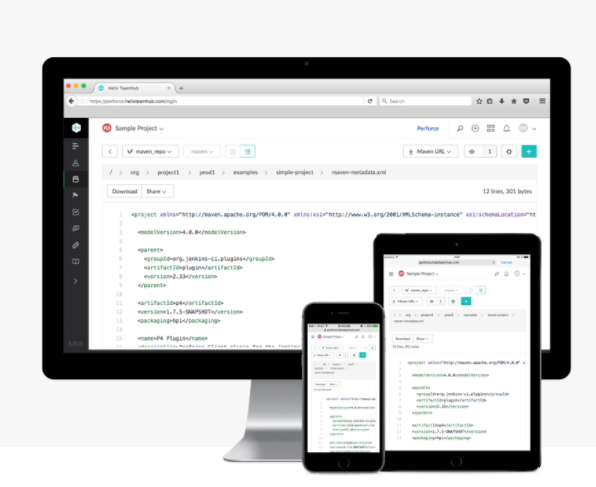

Headquartered in Minneapolis, Perforce claims to be the developer of the industry’s ‘most flexible, scalable and secure’ version control and collaboration platform. It provides solutions for a range of industry needs including audit and compliance, application lifecycle management, repository management, DevOps, IP Protection and project management, among others.

Following the deal, the company will continue to be led by Janet Dryer, CEO, and Mark Ties, COO, who will both join the Board of Directors alongside Clearlake.

“Today’s announcement represents another major milestone in our transformation of Perforce,” said Dryer. “Two years ago, we began this journey, and since then we have completed three acquisitions, returned the company to growth, and created a robust portfolio of DevOps-focused solutions adopted by the largest and most demanding enterprise development teams in the world. We thank Summit Partners for this outstanding partnership, and we look forward to working with the Clearlake team as we accelerate into our next phase of growth.”

The deal comes two years after Summit Partners, a global growth equity investor, today announced the acquisition of Perforce.

Today, Perforce serves more than 3,000 customers worldwide, serving the financial, energy, life science, government, game development, automotive and software industries. In the financial services space, the company claims its solutions can help customers stay ahead of the regulatory curve and maintain profitability.

With financial services firms facing the daunting task of maintaining profitability while simultaneously complying with strict regulatory mandates and keeping up with consumer expectations, its lifecycle management tool, Helix ALM, aims to make it easy to establish accountability, meet regulatory changes, and provide quality customer service. The product looks to lessen risk exposure with automatic notifications and escalations, automatic audit logging, and electronic signatures.

The company has offices in Minneapolis, MN, Alameda, CA, Mason, OH, the United Kingdom, Finland, Sweden, Germany, and Australia, and sales partners around the globe.

Last year, Clearlake Capital Group led a $65m financing round for MetricStream, a provider of governance, risk and compliance solutions. Singapore-based EDBI joined the round as a new investor, with existing investors Goldman Sachs, Sageview Capital, and others also participating. The deal came a few months after Summit Partners participated in the $75m funding of Darktrace, a machine learning cybersecurity developer.

Copyright © 2018 RegTech Analyst

Copyright © 2018 RegTech Analyst