blanco, a technology developer for asset managers, has raised €2m in its latest equity round.

This funding was supplied by Volta Ventures and KBC Start it Fund. Founded in 2015, the company looks to simplify asset management procedures for banks, and investment firms. One of its services is a fully automated KYC tool to determine the risk of customers by getting them to complete a questionnaire which is then used to make a judgement. Its client onboarding module also claims to register new asset management clients within the hour, cutting back the time they need to register a new client from hours and sometimes days to a maximum of 60 minutes.

blanco, based in the Netherlands, also offers a selection of tools to help companies to keep compliance with various regulations including MIFID II, money laundering, terrorist prevention act, and the financial supervision act. A wealth management solution is also available to clients, utilising robo-advisor technology.

With this funding, blanco hopes to grow its adoption in the Benelux region.

Volta Ventures general partner Sander Vonk said, “The proposition of blanco fits in perfectly with trends in asset and wealth management where margins are under pressure and regulations are changing at lightning speed. The large number of clients who chose blanco in a short amount of time proves this relevance. Moreover, the team is very strong.”

This is Volta’s second FinTech investment this year, having previously led the €1m Series A round to cash management provider Cashforce. The company implements smart cash flow management and forecasting solutions to help finance teams gain visibility and insights into cash flow.

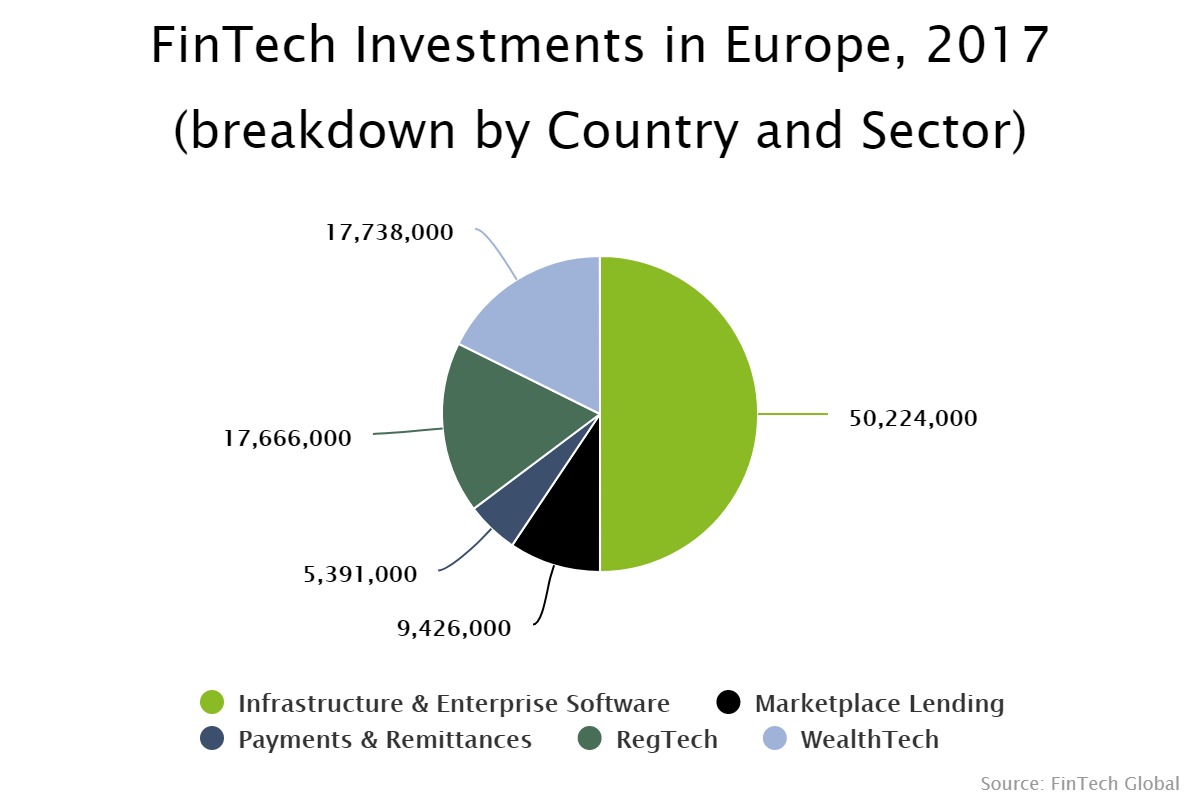

Last year, half of the funding into the Netherlands’ FinTech sector went to the infrastructure and enterprise software sector, according to data by FinTech Global.

Copyright © 2018 RegTech Analyst