The lion’s share of RegTech investment and deal activity has gone to companies in Europe and North America however, the industry is global, with more than $3.4bn raised by RegTech companies in other regions of the world between 2014 and H1 2019.

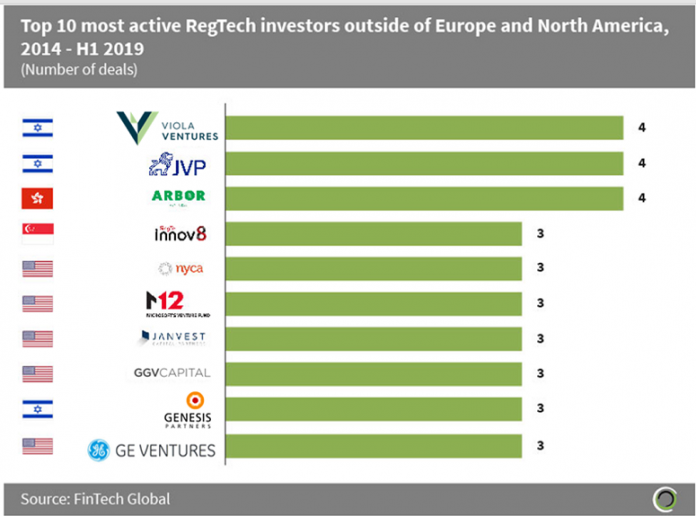

US and Israel-based firms have been the most active investors in RegTechs located outside of North America and Europe since 2014, with five and three investors, respectively, listed in the top 10.

Viola Ventures is Israel’s leading technology-focused investment group with over $3bn of assets under management and completed four RegTech deals between 2014 and H1 2019. Viola invested in the $9.5m Series A funding raised by Evercompliant, a merchant fraud detection and monitoring solution provider based in Tel Aviv, in December 2016. Viola Ventures was joined by Nyca Partners and Arbor Ventures in the round.

GE Ventures and M12 (Microsofts venture arm) are two US-based corporate venture funds that have each completed three RegTech deals outside of North America and Europe since 2014. M12 invested alongside Viola Ventures in the $15m Series A round that Israeli threat detection solution provider NsKnox, raised in Q1 2019. The funding will help NsKnox expand its global customer base and further develop its platform.

Copyright © 2018 RegTech Analyst