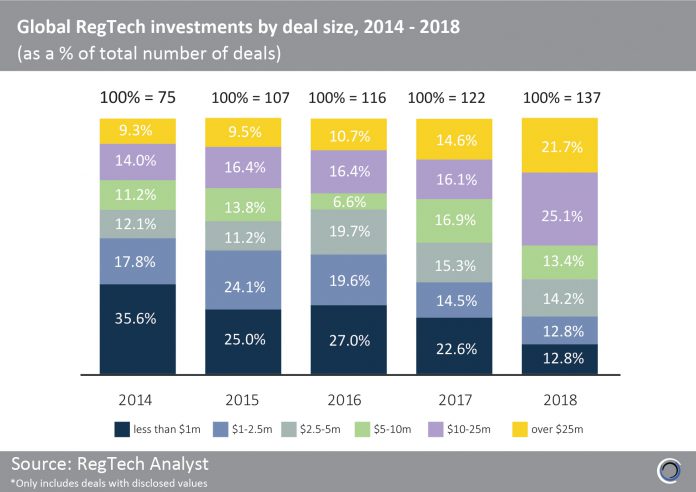

The proportion of RegTech deals valued below $2.5m fell from 53.4% in 2014 to 37.1% in 2017 as the industry shows signs of continued maturity. Last year the trend continued with just 25.6% of deals valued below $2.5m. Concurrently the distribution of deals by size has shifted upwards with the proportion of transactions valued above $10m growing from 23.3% in 2014 to 46.8% last year.

The RegTech investment landscape has seen year on year growth of deals valued over $25m with 31 transactions in this deal size range closed in 2018, as investors engage in more later-stage transactions. Anomali, a Silicon Valley-based threat detection solution provider, raised a $40m Series D round in Q1 2018 from investors such as Lumia Capital; an expansion-stage venture capital firm.

Symphony Communications provides email communication monitoring services to financial institutions and the company’s smallest funding round was $63m of venture funding raised in Q2 2017 from investors such as BNP Paribas, UBS, HSBC, JP Morgan and Goldman Sachs.

Ottawa-based Assent Compliance is a supply chain management software company that assesses third-party risks and educates stakeholders on regulatory and data program requirements. The company raised $100m of Series C funding from Warburg Pincus, which will enable Assent to continue the development of its product compliance and vendor management risk platform. This was one of the largest RegTech deals of Q4 2018.

Copyright © 2018 RegTech Analyst