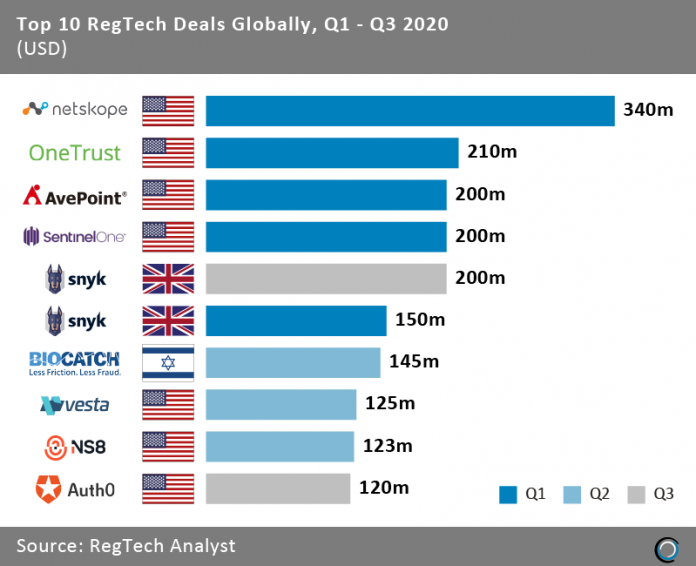

The top ten RegTech deals in the first nine months of 2020 raised in aggregate $1.8bn, making up 38.2% of the total funding in the sector for the period.

The total is slightly lower than the figure recorded during the same period in 2019 when the top ten deals raised 1.85bn. Investors have clearly downsized on the cheques they are willing to write post Covid-19 as five of the top ten deals this year took place in Q1.

US companies continue to dominate the RegTech sector, capturing seven out of the top ten deals. Netskope, a software company that helps organisations understand online activities, protect data and stop threats, led the way by announcing a $340m investment from Base Partners and nine other investors in a Series G round. Netskope said it would continue to grow and explore technology to further separate themselves in the cybersecurity market.

BioCatch, the only company within the top ten deals so far in 2020 outside of the US and the UK, announced a $145m investment with American Express Ventures and five other investors. The company which delivers behavioural biometrics said it would use the funding to expand its offering and verticals served.

Copyright © 2018 RegTech Analyst