While the top ten RegTech deals globally in the third quarter were all completed by companies based in United States, United Kingdom or Israel, investors are still backing businesses in the sector outside the leading RegTech innovation centres.

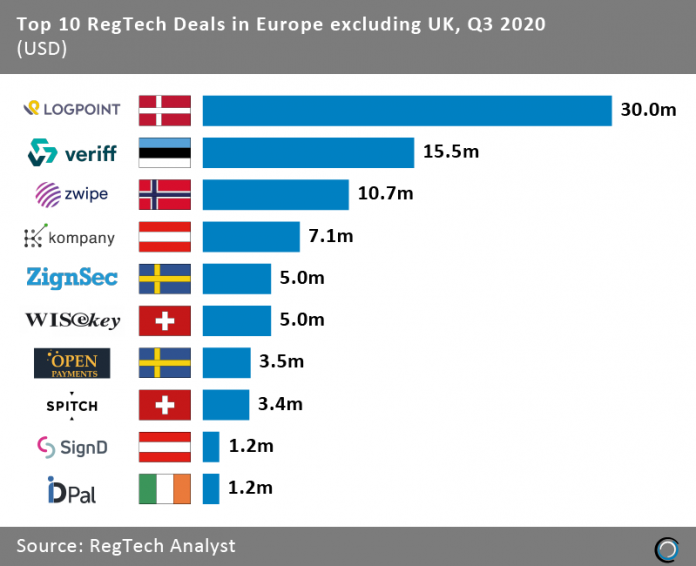

If we dive deeper into the RegTech activity in Europe outside of the UK we can see thriving local RegTech ecosystems with seven countries represented in the list of top deals in the region in Q3 2020.

The largest round on the continent during the period was completed by LogPoint, a Danish cybersecurity startup, which closed a $30m Series B round led by Digital + Partners. Funds from the round will be used to help the company enter new markets and further the development of its platform. The company’s previous capital raise was a $10m round back in 2017.

Notably, the top three RegTech deals all took place in the Nordics and Baltics regions. This is unsurprising given the governments in these countries actively seek to support local business by creating platforms for public and private sectors to collaborate. In fact, many FinTech startups are directly sponsored by government agencies, including lnvest Stockholm, Startup Estonia, The Danish Embassy in London, which support their ability to travel to meet global investors and growth partners. Veriff, an online identity verification platform, raised $15.5m to fuel its growth efforts which was the largest RegTech deal in the Baltics in Q3.

Copyright © 2018 RegTech Analyst