From: FinTech Global

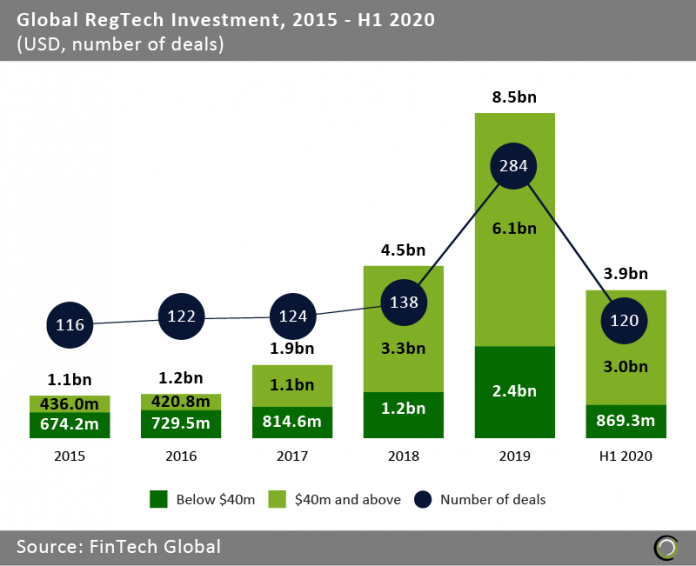

RegTech companies raised nearly $4bn across 120 deals in the first six months of the year

- Total investment in the RegTech sector rose significantly from 2017 to 2019 growing at a compound annual growth rate (CAGR) of 113%, as investors showed intense interest in the sector. The rise in total funding in 2019 was mainly driven by large deals over $40m which made up 71.7% of the total funding for the year. The sector’s record year saw an 88% increase in total investment from 2018 coupled with a 105% rise in the number of deals.

- H1 2020 saw a 5% increase in total funding compared to the first half in 2019 along with a 14.2% decrease in deal activity. While this may signal maturity in the sector via large deals, the lack of deal activity can also be attributed to investors’ uncertainty caused by Covid-19 and their unwillingness to commit to early stage, riskier transactions.

- If the current funding pace continues for the remainder of the year, 2020 is on target to set a new record for total capital invested. With companies are moving operations digitally and working remotely, regulatory technology is more important than ever as legacy compliance processes are redesigned.

US companies continue to dominate the RegTech space, capturing 80% of the top ten deals in H1 2020

- The top ten RegTech deals in H1 2020 raised in aggregate $1.9bn, making up 48.7% of the total funding for the period. For comparison in H1 last year, the top ten deals totalled just over $2.1b with 2019 ending up being the hottest year for RegTech investment.

- US companies continue to dominate the RegTech sector, capturing eight out of the top ten deals. Netskope, a software company that helps organisations understand online activities, protect data and stop threats, led the sector by announcing a $340m investment from Base Partners and nine other investors in a Series G round. Netskope said it would continue to grow and explore technology to further separate themselves in security.

- BioCatch, the only company within the top ten deals of H1 2020 outside of the US/UK, announced a $145m investment with American Express Ventures and five other investors. BioCatch, a cybersecurity company that delivers behavioural biometrics, said it would use the funding to expand its offering and verticals served.

Singapore continues to make good on their promise to promote RegTech innovation despite Covid-19 hurdles

- Though the US captured 80% of the top ten deals of H1 2020, the country dropped 8.1 percentage points (pp) in its deal share from 2019. The nation peaked in deal share in 2016 when companies in the country captured 63.1% of all deals completed during the year. Despite the 8.1pp drop, the US is still home to just over half of all RegTech deals raised in the first half of 2020.

- Singaporean companies increased their deal share by 3pp in the first half of 2020, bringing it to an all-time high of 5.1%. The country has seen an overall 3.9pp increase in deal share since 2018. Singapore has been committed to RegTech growth since early 2016 with the government proactively utilising RegTech developments in their regulatory capacity. The growth follows efforts by The Monetary Authority of Singapore (MAS) to merge money exchange and remittance systems law into one legislation. Additionally, Singapore is increasingly becoming a hub for blockchain innovation with an abundance of companies creating successful digital identity, mobility, trading, and more.

- Israel is another country that has seen strong growth in the RegTech sector. From 2015 to 2017, Israel saw a 2.8pp drop in their deal share. Since then, companies in the country have increased their deal share by nearly 4x. Israel is renown in the cybersecurity industry being a home to a multitude of innovative solutions from their strong military and cybersecurity education.

Investors pour increasing amount of capital into RegTech companies as the share of deals over $50m nearly doubles since 2018

- From 2015 to 2018, the share of deals over $50m has risen 15.8 pp with a consistent rise in deal activity. In 2019, the RegTech sector’s most prosperous year yet, there was a further 7.2pp increase coupled with a 105% increase in overall deal activity. In H1 2020 deals over $50m are just shy of taking up 20% of all deals during the period.

- Despite other FinTech sectors, which are experiencing a slowdown given the effects of COVID-19, the RegTech industry saw a 5% increase in total funding in H1 2020. H1 2020 saw the highest number of deals over $50m to date.

- From 2015 to 2019, deals under $1m dropped 20.7pp while the number of deals continued to rise, indicating that investors started to fund companies in larger funding rounds. In that same period, deals sized $50m and over nearly tripled. However, deals under $1m more than doubled in H1 2020. The change comes when investors may be looking to back new innovation around remote work and other disrupted areas of business that have been affected by the coronavirus.

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global.

Copyright © 2018 RegTech Analyst