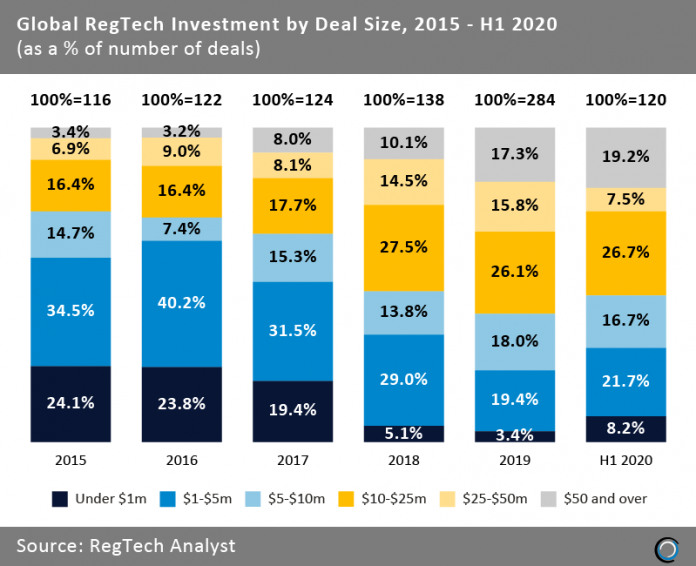

Investors pour increasing amount of capital into RegTech companies as the share of deals over $50m nearly doubles since 2018.

- From 2015 to 2018, the share of deals over $50m has risen 15.8 pp with a consistent rise in deal activity. In 2019, the RegTech sector’s most prosperous year yet, there was a further 7.2pp increase coupled with a 105% increase in overall deal activity. In H1 2020 deals over $50m are just shy of taking up 20% of all deals during the period.

- Despite other FinTech sectors, which are experiencing a slowdown given the effects of Covid-19, the RegTech industry saw a 5% increase in total funding in H1 2020. H1 2020 saw the highest number of deals over $50m to date.

- From 2015 to 2019, deals under $1m dropped 20.7pp while the number of deals continued to rise, indicating that investors started to fund companies in larger funding rounds. In that same period, deals sized $50m and over nearly tripled. However, deals under $1m more than doubled in H1 2020. The change comes when investors may be looking to back new innovation around remote work and other disrupted areas of business that have been affected by the coronavirus.

Copyright © 2018 RegTech Analyst