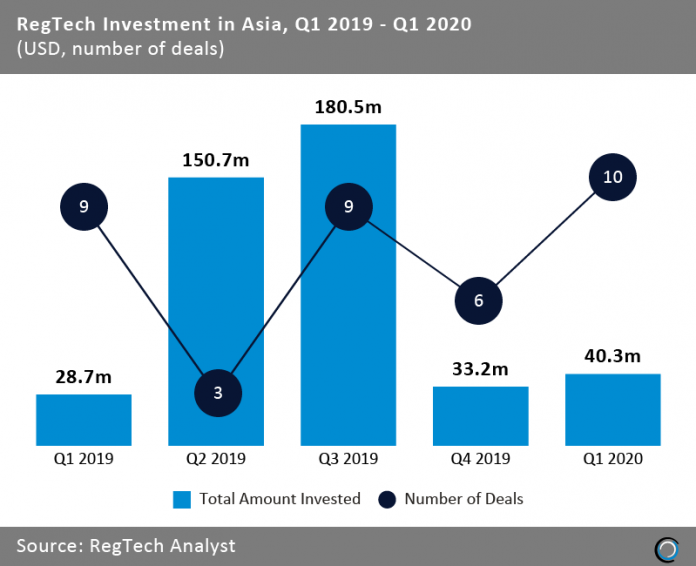

RegTech companies in the region completed ten transactions raising $40.3m in total

Investment in Asian RegTech companies recorded a strong first quarter despite the spread of the coronavirus outbreak and the ensued economic uncertainty. As digital transformation in financial services is accelerated amid the social distancing measures and remote working environment, investors see a strong case for the RegTech sector since most compliance processes still require on-premises IT infrastructure.

Companies in the region raised $40.3m across ten transactions in the first three months of 2020. While the funding total is lower than the record raised in Q3 2019, the total amount invested was still 40.4% higher compared to Q1 last year and 21.4% higher than the preceding quarter. Furthermore, deal activity reached a five-quarter high of ten transactions further supporting the healthy level of interest from in investors in the Asian RegTech industry.

The largest deal of the period was completed by Horangi, a SaaS cybersecurity company, which raised $20m in a Series B round led by Provident Growth Fund. The company will use the funding to expand further in Southeast Asia and enhance its cloud security platform Warden, integrating AI and machine learning technologies to help organisations stay ahead of advanced threats.

Copyright © 2020 RegTech Analyst

Copyright © 2018 RegTech Analyst