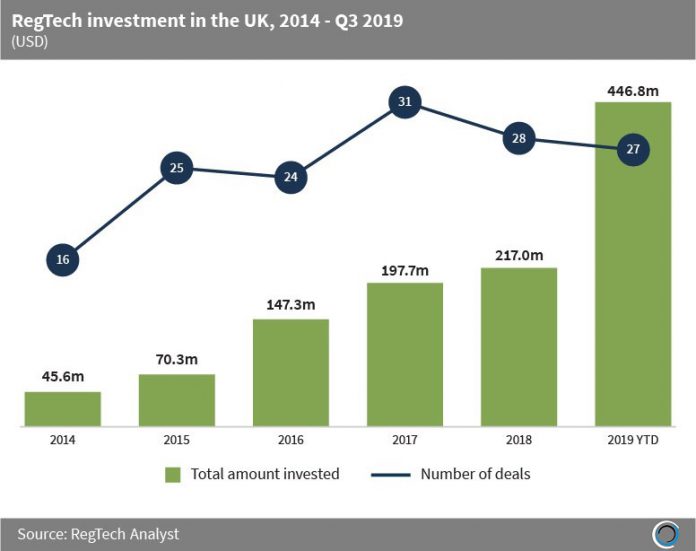

RegTech companies in the UK have raised more than $1.1bn across 151 transactions since 2014, with almost half a billion dollars of this raised in the first nine months of 2019.

Investment increased at a CAGR of 47.7% between 2014 and 2018, with the deal activity in the first nine months of 2019 almost level with the number of transactions recorded last year.

Almost half of the capital raised by RegTech companies across Europe this year has been captured by companies based in the UK, with this dominance further evidence of the position that the FCA has played in creating a conducive environment for innovation within RegTech. This growth in investment has seen average deal sizes in the UK increase from $2.8m in 2014 to $16.5m in the first three quarters of 2019.

Snyk, a London-based cybersecurity and compliance solutions provider, raised $70m from GV, Accel and Boldstart Ventures in a Series C round in September 2019. This was the largest RegTech deal in the UK last quarter and puts the company in a strong position to accelerate its go-to-market strategy, continue to drive massive growth in product adoption and usage, and continue its expansion into new global markets.

Copyright © 2018 RegTech Analyst